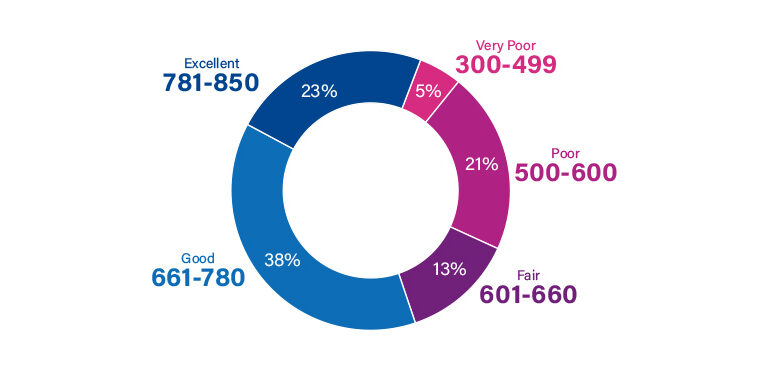

A credit score is perhaps the most important piece of data found on your credit report.

It is a figure that indicates how good you have been with handling your finances.

Calculation of credit score takes into account a number of factors such as your timely payments, debt, credit utilization ratio, etc.

A good credit score means you can aim for better credit cards or get approved for loans with betters terms. So how can you improve your credit score fast? We will tell you some tips that always work!

A good credit score means you can aim for better credit cards or get approved for loans with betters terms. So how can you improve your credit score fast? We will tell you some tips that always work!

A good credit score means you can aim for better credit cards or get approved for loans with betters terms. So how can you improve your credit score fast? We will tell you some tips that always work!

1. Remember to Make Timely Payments

This has to be the biggest factor that affects your credit score. Timely payments indicate that you are a responsible person who has the resources to clear bills on time.

When credit card lenders see this, they would be more comfortable providing you with high-end cards and fewer fees.

If you have trouble remembering when a payment is due, you can set in alarms and alerts on monthly basis. Some cards now come with compatible mobile applications that let you set in reminders for important dates.

2. Maintain a Low Credit Utilization Ratio

When you receive a credit card, you would be given a limit that you can make use of. Spending more than the limit means you are exceeding the credit that the bank offered you.

This would leave a bad impact on your credit score. Instead, it is best to maintain a low credit utilization ratio by spending only 30% of the allotted credit limit.

If you even spend more than the ratio suggested, you can always clear the bill as soon as possible so it does not show up on your credit report. Studies suggest that timely payments and a low credit utilization ratios are enough to repair a poor credit score.

3. Do Not Apply For Multiple Credit Cards

Whenever you fill and submit a credit card application, the bank or lender would carry out a hard inquiry on your credit report.

A hard inquiry is kind of a thorough check into your finances in order to see if you are capable of handling a credit card or not. Unfortunately, a hard inquiry has an impact on your credit score. Therefore, multiple inquiries mean that your score will take a dig.

If you wish to avoid this, it is best to only apply for credit cards when needed. A lot of plastic in your wallet can get difficult to handle as well. Choose the cards you need wisely.

4. Clear Off Debt

Debts or the payments you owe to a company can remain on your credit report for a very long time. Although their effect can be minimized by maintaining good credit-related habits, as long as they stay on the report, your score will not bloom.

Therefore, if you have the resources, make it your priority to clear debts as soon as possible. You can do it in installments but paying in full would boost your credit score more quickly.

5. Dispute Any Errors That You Find on the Report

Credit reports are assembled by the credit bureaus. Since there is human intervention involved, there are solid chances that some error or a glitch shows up on your report that pulls down your score. For example, sometimes the debt that you have already cleared does not show up in the data.

Therefore, we suggest our readers keep a check on your report. There are a number of platforms that provide free credit report access. It is a great habit to go through your report at least thrice in a year.

That’s it, friends! We hope that these little tips and tricks help you improve your credit score quickly. Let us know about your credit-repair journey in the comment section below!

My Name is Hazel. I like to write about , finance, Tech, Software’s & more. Other then that i love football & travelling new places.