If you are an entrepreneur or a business person searching for the most suitable business credit card with rewards and purchase protection, Getinkpreferred is your answer!

2.Just visit the site www.Getinkpreferred.com for Chase business card login and provide the 12-digit invitation number along with 5-digit Zip code in order to proceed.

3.With this credit card you can win 80,000 bonus points by spending $5000 in the first 3 months of becoming a cardholder.

…and Much More!

When we think about a card that could help a business grow, how can we forget the Getinkpreferred Chase Business credit card?

Chase Ink Preferred Business credit card is an outstanding must-have for all customers who wish to get help growing their business.

The approval won’t be an issue, especially if you have an excellent credit score.

Chase provides other options, such as Chase Ink Business Premier and Chase Sapphire Preferred. But what makes this card our favourite pick? Let’s explore!

Ink Business Preferred Credit Card Review

- $0 balance transfer

- $0 introductory APR

- $0 annual fee

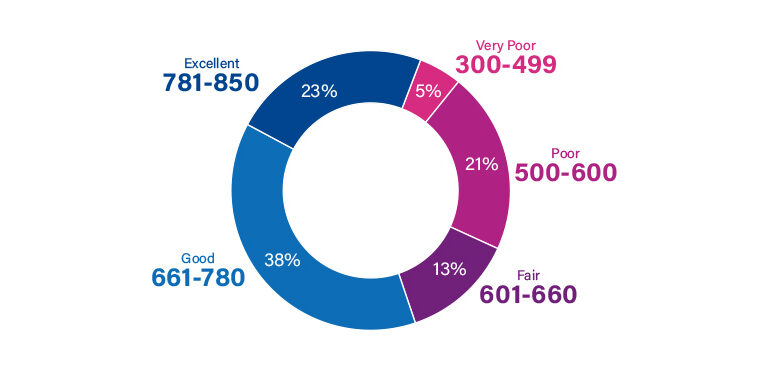

Required Score: Good to Excellent

Annual Fee: $95

Purchase APR: 17.49% to 22.49% Variable

The first thing you need to consider when utilizing this credit card for your business is that it comes with some extra charges.

Fees

First, you must pay an annual fee of $95. This is common for business-related cards since most of these carry hefty yearly membership fees.

In addition to this, you also have to pay a 3% balance transfer fee and a 5% cash advance fee whenever you use these features.

If you are late with a payment, the bank will charge a penalty fee of $39. The returned amount also comes with an additional $39 charge.

As for the Annual Percentage Rate applicable on this card, the exact values depend on your creditworthiness.

Interest Charges

Purchase APR is 17.49% to 22.49%, and APR on balance transfer is 17.49% to 22.49%. The APR applicable on cash advances is 26.49%.

Chase Ink Business card carries high-interest charges. However, it would help if you remembered that all these fees can be easily avoided by making timely payments, preferably in full.

Are all these charges worth the Chase Business credit card’s benefits?

How To Respond to Mail Offer At Getinkpreferred.com Invitation Number

A mailing offer for pre-screened customers now backs up Chase Ink Credit Card and is then selected for a particular application procedure. Pre-approved mail offers shorten the time it takes to apply for the card.

Customers already considering applying for an Ink Preferred Business credit card can benefit from receiving this offer in the mail.

Just visit the site www.Getinkpreferred.com for Chase business card login and provide the 12-digit invitation number along with a 5-digit Zip code to proceed.

Once you have finished the application, you might be required to provide data related to your business, such as several employees or annual business sales. After that, wait for 10 to 14 days till the bank processes your application.

Steps To Take In Case Your Mail Offer Is Missing

You can take multiple routes to continue with the card application if you have yet to receive the mail offer.

First, on the same official page, you would find a button stating, “Look up your invitation number”. This would ensure that you are eligible for the pre-qualified offer.

Other than that, You can also apply for an offer that does not need a confirmation number. This standard application procedure requires you to enter your full name, social security number, address, phone number, etc.

Why Should You Choose Getinkpreferred?

You should consider the Ink Preferred Business card for several reasons if you are searching for a perfect business credit card.

You Can Enjoy Extra Rewards

The first and the foremost reason is that it comes with a wide range of perks. You can win 80,000 bonus points by spending $5000 in the first 3 months of becoming a cardholder.

In addition to this, you will win 3 points on every dollar that you spend on travel, purchases, internet packages, advertising services, phone services, and shipping. The card is widely accepted by merchants around the globe and it is a handy tool to save money on your overseas purchases.

Additional Perks In Common Business Spending Categories

Most of the rewards on this credit card are related to combined spending categories, including travel, shipping, internet, cable, telephone services, advertising purchases, social media sites, search engine services, etc.

All these categories are in high demand for entrepreneurs or business people working towards a company’s growth.

Offering rewards on combined categories is also a massive perk since most business cards limit it to a single class only.

In contrast, you can use the Ink Preferred card to earn rewards in multiple categories you will most likely use for your business setup.

Travel Points Can Be Redeemed Easily

You can also transfer the points to other leading travel programs without loss. Ink Preferred lets you avail of a 1:1 transfer and does not charge any foreign transaction fee.

The transfer partners working with Getinkpreferred include Aer Lingus Aerclub, Flying Blue, World of Hyatt, United MileagePlus, Emirates Skywards, Iberia Plus, and many others.

Ink Business Preferred has partnered with good companies abroad to provide you with the best experience.

Full Customer Protection

Luckily, the card also offers zero liability protection, cell phone protection, fraud protection, purchase protection, and employee cards with no extra charges. Furthermore, you can make use of an auto rental collision damage waiver.

For example, if you rent a car via this credit card for business purposes, you would be covered for theft and damage.

On top of that, if your trip is cancelled due to an unexpected event, you would be eligible for $5,000 of coverage per person for travel expenses.

As mentioned above, Ink Preferred Business credit card offers purchase protection.

This implies that any product purchases via this card are covered, and in case it gets damaged or stolen, you can claim up to $10,000 per claim or $50,000 per account.

The credit card pays up to $600 per claim for cell phone damage or theft when the bill is delivered through the card. You are allowed a maximum of 3 shares in a year (12-month period), with a $100 deductible for each claim.

FREE Employee Cards

You can add authorized users to this account, such as your trusted employees. This would get you free employee cards you can utilize to earn more rewards.

Besides that, you will be free to set account limits to restrict the spending allowed for each employee. The changes can be made by visiting the Chase Ink credit card login portal.

You Should Keep In Mind The High Annual Fee

The yearly fee for this credit card is around $95. There is no way to avoid this in the first year, so you might feel like you couldn’t enjoy the rewards it offers to the fullest.

Alternatively, no-fee credit cards like the Bank of America Business Advantage Credit Card save you from paying annual charges and offer 1.5 points per $1 spent on all purchases.

The Interest Charges Are Hefty

Readers need to know that interest is high on Ink Preferred Business cards. Furthermore, the balance transfer fee is considerable as well. If you wish to make the most of travel rewards, it is better never to carry a balance on this credit card. Moreover, there is no introductory 0% APR period.

The Perks Might Not Match Your Spending Pattern

The rewards on this card are not limited to a single category. It is a good thing that the credit card offers travel points and perks on several spending categories, but it is still possible that these might need to match the fields where your business is making the most of the expenses.

Extra Reading

Is Getinkpreferred Legit or Scam?

Chase Ink Preferred Business credit card is a secure option that guards your personal information to the best of its abilities.

Furthermore, it provides all sorts of customer protection to make your experience with the card smooth and safe. Its key features include zero liability protection, purchase protection, fraud protection, and extended warranty protection.

Chase customer support service is readily available, so you should immediately contact a representative if you need help or wish to share a query. Below are the details for getting in touch with their representatives.

Chase Ink Customer Service

The official page for Chase Bank hosts expansive customer support services. They have devised categories related to queries that most customers are asking so you can quickly jump into the relevant chat box to discuss your issue.

If you wish to get direct help, the service is available at 1-800-935-9935.

Luckily, the bank also caters to customers with disabilities such as deafness or impaired speech. Such users are encouraged to call at 711 for assistance. Finally, you can connect with the bank on social media at @Chase Support or Facebook.

Note! Towards the end of the same page, you can find a link labelled “Schedule a meeting”. You can use this to book an appointment with a banker to discuss your problems or to open an account.

The Bottom Line

Setting up a business and making it successful is a challenging job. You will need all the right tools to ensure your efforts are well-spent.

Credit cards can help you a lot. However, you can not rely on cards meant for personal use.

Although many options are available, the Ink Preferred Business credit card stands out for several reasons. It generously lets you win bonus points. You can avail of these for travel benefits and other discounts.

Luckily, the card also offers zero liability protection, cell phone protection, fraud protection, purchase protection, and employee cards with no extra charges. Furthermore, you can make use of an auto rental collision damage waiver.

What are you waiting for then?

Frequently Asked Questions

Is it challenging to get accepted for a Chase Ink Business card?

It would help if you had a credit score of at least 740 to apply for this credit card confidently. Getting approved with a lower score is possible, but that means the rest of the information on your credit report should be in good shape.

What is meant by a preferred credit card?

Preferred credit cards typically require powerful credit reports to be approved for. This card often provides more benefits as compared to traditional ones.

Can you apply for an Ink Preferred Business credit card without owning a business?

Unfortunately, you can not apply for this card unless you have a business since this is the main requirement of the credit card. On the contrary, your business does not need to have employees or a workspace.

Does it take long to get approved for Chase Ink Preferred?

Mostly, you will get to hear from the bank within a week. If you are lucky, you might receive the approval immediately. If you are still waiting for an update within 14 days, contacting the bank’s customer support service is best.

Are there any alternatives to Ink Business Preferred?

There are several business credit cards that you can get easy approval for. This includes Capital One Spark, Wells Fargo Business Secured Credit card, and Staples Business credit card.

Does a Chase Ink referral get me a bonus?

Chase does give a referral bonus if you invite other business owners to apply for the credit cards (Ink Business Cash Credit Card, the Ink Business Preferred Credit Card, the Ink Business Unlimited Credit Card, and the Ink Business Premier).

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.