The most important information that you would find on a credit report is your credit score.

Many customers still wonder what is credit score and why is it important.

Therefore, we will go through this quick guide and explain to you what credit score means, why you need a good credit score, and also how the figure is calculated.

What Is Credit Score?

A credit score is a simple figure calculated to explain where you stand when it comes to applying for a credit card, loans, mortgages, etc.

Calculating a credit score takes into account many different factors such as timely payments, debts, credit utilization ratio, credit history, etc.

A good credit score means it would be easier for you to get approved for loans or cards. You can also qualify for better terms or get pre-approved card offers.

But, how do you know if your credit score is good or bad?

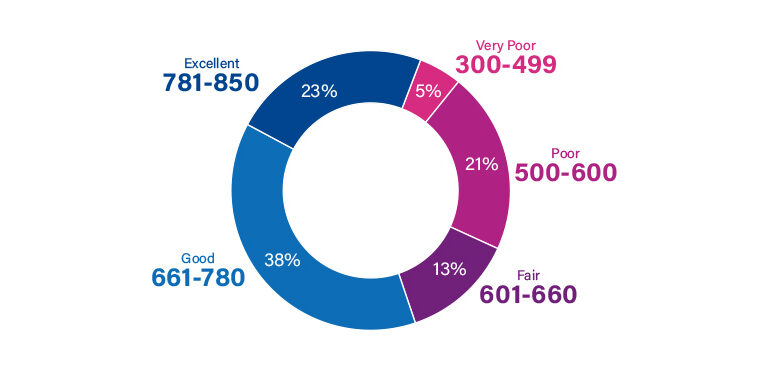

A credit score is a range of numbers from 300 to 850. Where you stand on this scale determines how good your score is.

Typically a score above 550 is considered to be good enough. However, when looking at FICO scoring, this is how the breakdown works:

Poor: 300 – 579

Fair: 580 – 669

Good: 670 – 739

Very good: 670 – 739

Excellent: 800+

Why Do You Need a Good Credit Score?

Your credit report would contain all the information ranging from your credit history, payment patterns, and any debt that you owe.

However, that is a lot of data to process for a lender or a company who simply wants to know if you will prove to be a reliable customer.

Therefore, most of these only take a look at your credit score since the number can say a lot about your ongoing financial situation.

As you would see, poor credit scorers can often only apply for secured credit cards.

These cards charge a hefty fee as security which would not be returned in case you fail you use the card responsibly.

Similarly, a good credit score also means you can be accepted for a loan with better terms and conditions.

Seeing a good figure on your report would ensure the lender that you are responsible for your finances and you would be able to return the money as promised.

How Is Credit Score Calculated?

In order to ensure that you are not just being provided with a vague number, credit bureaus have devised a formula that is used to calculate how credit score works.

If you wish to know how the score on your report was calculated, this is how it works:

- 35% weightage for payment history

- 30% weightage for the amount owed

- 15% weightage for the length of credit history

- 10% weightage for new credit

- 10% weightage for types of credit used

How To Maintain a Good Credit Score?

By now you know why a good credit score is important and how this score is calculated. So, we come down to the final question, how can you ensure you have a better-than-average credit score?

Looking at the breakdown of calculation, you can observe that payment history has the highest weightage.

The payment history takes into account how timely you clear your bills every month. If you have frequent late payments shown in the report, the score would eventually take a dig.

The next big factor is the amount you owe. This can be viewed as both, the debts on you and the amount you owe to the bank in terms of a credit utilization ratio.

The ratio is important and it is always suggested to maintain it below 30% if you wish to boost your credit score fast.

Most of the time, working on these factors is enough for getting a good figure on your report.

Inculcate these habits in your expenditure pattern from today and you would be able to see a clear improvement in your score in just a few months.

My Name is Hazel. I like to write about , finance, Tech, Software’s & more. Other then that i love football & travelling new places.