Who is the Ollo card suitable for? Anyone who wants to improve credit score, increase credit line, and save fees on introductory offer. It sounds like the card is for YOU, and GetMyOllocard is the perfect place to start.

Ollo services manage Ollo Platinum Mastercard. The Bank of Missouri has established this and allows legal residents of the US who are above 18 years of age to apply.

- Ollo sends out pre-approved mail offer, Getmyollocard, with reservation number and access code to simplify the application process online.

- The card is perfect choice for people struggling with poor credit score. It comes with

- The bank also promises automatic credit line increase if you stick to timely payments and good spending habits.

…and Much More!

Why You Should Choose GetMyOllocard?

Ollo Card Services provides Ollo Mastercard. These are under the control of Missouri Bank. As the name shows, the service is highly reliable, so you do not need to worry about your personal information being leaked to an unknown third party.

Moreover, the card comes with no annual fee and minimal interest rates. This is an excellent catch for customers who have just started their credit-rebuilding journey.

The main perk of choosing Ollo Platinum Mastercard is that it reports to the major bureaus about your credit-related habits. If you maintain timely payments and pay in full, your credit score improves quickly.

These are just a couple of reasons why we would want you to consider Ollo services when looking for a new card. In the next section, we would further explore what features the card can offer you and how you can apply for it online with or without the mail offer.

GetMyOllo Platinum Mastercard – Highlights

- No annual fee

- 0% intro charges

- Quick credit line increase

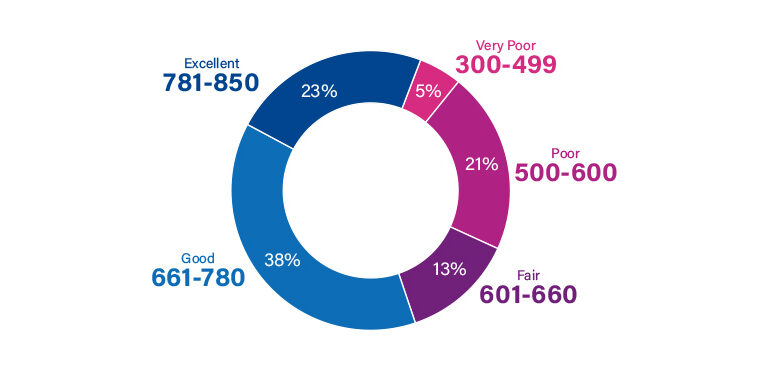

- Credit Score 350 – 850

- Required Score: Fair to Good

- Annual Fee: $0

- Purchase APR: N/A

As we have pointed out, the card is a fantastic choice for people who want to boost their FICO score fast. It has several features that make this process short and easy.

First of all, the card does not charge any annual fee. This makes it easy to maintain a credit card without worrying about additional expenses. On top of that, it is also free of the hassle of foreign transaction fees. You can use the card anywhere other than the US, and you would not have to pay an extra penny!

There is also no penalty charged if you submit a fee late. Although this card has no additional rewards, its minimal maintenance costs make it a good option for those struggling with good credit.

Moreover, the bank also offers automatic credit line increases. If you maintain timely payments, clear off debts, and keep the credit utilization ratio, you can avail of an increased credit limit in just a couple of months.

How To Responds To Mail Offer With GetMyOllocard Com Reservation Number

The pre-approved mail offer sent from Ollo promises to reply to you within a minute. All you need to do is visit www.GetMyOllocard.com and log in. Here, you will be asked to provide the following:

- Reservation Number

- Access Code

Both of these numbers will be mentioned in the mail offer you received. They are typically present at the bottom of the letter sent to you.

What To Do In Case Your Mail Offer Is Missing?

If you face any trouble during the application process or have queries, please call their toll-free number 1-877-494-0020. This would get you in touch with their representative, who can further help you with the issue that you are having.

Note! The number mentioned above is available for the residents of the US only. For customers residing in other parts, Getmyollocard phone number, 1-516-224-5600, should be used instead.

Another way of contacting the authorities is to write via mail. The posting address is as follows:

P.O. Box 9222 Old Bethpage, NY 11804-922.

How To Activate Ollo Card?

You can activate the Ollo card through the website or mobile phone. The latter is quite convenient as you only need to dial the official contact number, 1-877-494-0020, to request activation. The process is typically completed within a couple of minutes.

Note! You have to share social security number and expiry date for the card at the time of activation.

You can also complete the activation process online if you have an internet connection.

- Open the official website and click on the Activate Card button.

- Then, provide the data such as social security number, date of birth, card expiration date, etc.

- You may be required to submit a few details to match the application of the Ollo card.

- Finally, you can click on the Activation button to complete.

Extra Reading

GetMyOllocard – Legit or Scam?

You get a mail offer and look into the perks of the credit card they want you to apply for. Everything seems to be according to your liking, but then one question hits you.

Is this legit?

Many customers have yet to determine the authenticity of Ollo card services. Since they are asked to provide their personal information to some degree, only some users are comfortable with going ahead with such an application.

However, there is nothing to worry about! Rest assured that your data will be safeguarded at every cost. Ollo Platinum Mastercard is a very secure option for credit cards.

Getmyollocard Reviews

So far, users have admired what the Ollo card offers them. They also think the customer support time is helpful and quick in response. Most users are happy that the card provided them an easy way to fix their credit score.

Moreover, users find their application method seamless and time-efficient.

The Bottom Line

Now you know what has made Ollo Platinum Mastercard one of our favorite choices in the world of credit cards. We recommend you grab the getmyollocard.com approval offer right now!

The associated fees are little extra charge that you would have to deal with in exchange for the card that would ultimately be your way towards a better credit score.

With 0% introductory APR and no annual fee, the Ollo Mastercard can be easy to maintain. At the same time, the bank reports to all three major credit bureaus.

This means it can help you rebuild your credit score by bringing your good habits to the notice of bureaus.

What are you waiting for? If you were lucky enough to receive the GetMyOllocard offer in your mail, log on to their official webpage and apply for one of the best credit cards in the market.

Frequently Asked Questions

What is the Getmyollocard credit limit?

The starting credit limit for Ollo Rewards Mastercard is $300 or more.

Is Getmyollocard customer service sound?

Yes. You can contact the bank’s customer support team by calling their toll-free number 1-877-494-0020.

Does Ollo have a new name?

The Company now goes by the name Ally. You can visit Ally.com to continue to manage your previous account.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.