A poor credit score and the inability to manage a security fund for a secured card? That sounds like trouble, but it should not mean you must dismiss the idea of getting a credit card altogether. With the doubleyourline Merrick bank credit card, you can get a credit card with higher approval odds and increase your credit limit in just 7 months!

- Merrick bank automatically increase your credit line after 7 months of responsible use.

- You can apply for the credit card by visiting www.doubleyourline.com, mailoffer.merrickbank.com and providing the acceptance certificate along with name and email ID.

- Keep in mind that the card has high APR, $72 annual fee and account set up charges as well.

…and Much More!

DoubleYourLine Merrick Bank – Everything You Need To Know

When you have many credit card options in the market, is it necessary to choose a Double Visa card over others? If you were wondering what the perks of becoming a Merrick Bank customer are, here are a few things that will answer your doubts.

- After you have completed Doubleyourline.com login and signed up for the card, stick to making timely payments for at least 7 months. The bank would then automatically increase your credit line without any hassle!

- The mobile app they offer contains all the features that the users want on the tip of their fingers.

- You will also get a free update on your FICO scores each month, as provided by the credit bureau.

- The bank promises $0 fraud liability protection.

- The Visa card comes with no hidden fees. You can forget about additional card charges, minimum interest charges, returned payments, card replacement fees, foreign transaction fees, etc.

You might be interested in reading: Lowes Credit Limit Increase.

Merrick Bank DoubleYourLine Visa Credit Card

Double Your Line at a Glance

- Treat for poor credit score

- Increases credit line automatically

- Free monthly credit score check

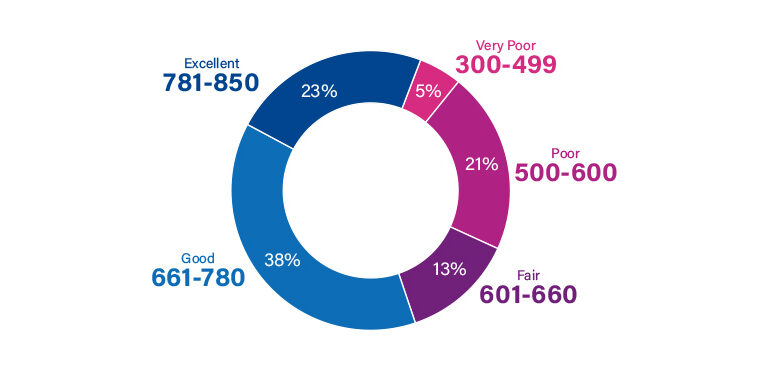

- Credit Score 350 – 850

Pros

- Double Your Line Visa credit card is a treat for those facing a poor credit score.

- It is no different from other visa cards, which charge up to a $72 annual fee. You must pay a one-time fee of $75 when getting the card.

- The APR is also set at 27.7%.

- The credit limit and associate increase are the best part of getting this card.

- You might be offered an initial limit of $550. This will automatically double after you continue to make timely payments for 7 months.

- This is a significant advantage as many other competitive cards have a hassle-filled credit increase process.

- Other banks may also require you to wait for at least a year before they will consider increasing your credit line. The worst is that some banks charge a 25% fee for increasing the credit limit. That is not the case with Merrick.

Cons

- The high annual fee has been a downside for many users. It charges $72 which is a high-end fee when it comes to unsecured charges.

- Furthermore, some customers will have to pay an account set-up fee.

- This is a $75 charge for a Double Your Line visa card.

- Setup charges reduce the initial credit limit available to you and therefore it might make your first month with the card pretty disappointing.

- Lastly, the card also has a steep APR. If you carry a balance or forget to make timely payments, that would mean you would end up paying a lot as interest charges.

- The high APR makes it difficult to afford this card in the long run.

How To Accept The Online Offer at Doubleyourline.com – Step By Step Guide

If you were lucky enough to receive a mail offer from the Merrick Bank, respond as quickly as possible. The process takes just a minute, and in the end, you might become a cardholder in the easiest way possible.

- Open your web browser and access www.doubleyourline.com application online mailoffer.merrickbank.com.

- Here, you would only need to enter three pieces of information: www.doubleyourline.com Acceptance certificate number, Last name, Email ID

- After you have entered these numbers, click on “Apply Now”.

The process will begin instantly, and you will hear from the bank within a week about the acceptance or rejection of your request.

You might be interested in reading: Getmyoffer.capitalone.com.

Steps To Take If Your Mail Offer Is Missing

You can be an eligible customer and still receive no credit card offer in the mail. That is okay! You can contact the bank to see if you qualify for a pre-approved mail at www.doubleyourline.com.

For this purpose, you need to open the official page for Merrick Bank and click on “See if you match a pre-qualified offer from Merrick Bank.”

This would take you to a digital form you must complete to check. Remember that this is not a soft inquiry and will not affect your credit score. The paper will ask you to provide the following details.

- First Name

- Middle Name

- Last Name

- Address Type

- Date of Birth

- Social Security Number

- Your travel history

- Email ID

Note! After you have typed in all the required information, click on “See If I Match”. You would get a response from the bank within seconds.

What You Can Do To Have The Best Experience With This Card?

You have a poor credit score, which is why you want to be approved for this card. If that is the case, then there is a lot you can do to ensure that the card helps you in the best way possible to fix your credit score.

Your first job would be to pay all the bills on time. Payment behavior has a significant impact on the overall FICO score.

- Late payments and debts can pull down your score rapidly. On the other hand, sticking to punctual bill payments might be the quickest way to qualify for a credit line increase.

The other goal should be to maintain a good credit utilization ratio. Financial analysts suggest this ratio must be under 30% for the best results.

If you don’t want to deal with interest charges now and then, a good approach is to make total payments. This becomes all the more relevant for cards with high APR since you would want to avoid the considerable interest amount the bank would charge on late or incomplete payments.

You might be interested in reading: Will Dovly Help Boost My Credit Score?

The Bottom Line

You can see that the Doubleyourline card offers several perks but also comes with a few charges. Since the terms and conditions on the card are excellent for anyone wishing to fix credit scores, we suggest you immediately respond to the mail offer and see how it goes.

- The trick to improving credit history is to be consistent with good habits.

All your punctual payments, total payments, and a good credit utilization ratio would show up on the report with time and help boost the credit score. However, if you are looking for a fix overnight, that might not be possible! Make good use of credit cards a habit, and you will see the results soon.

Frequently Asked Questions

Does Doubleyourline have good reviews?

Doubleyourline Mastercard has a good overall credit card rating and positive reviews from the users. It is admired for automatic credit line review and increase, easy setup. However, some users seem to have a problem with high APR and no reward program.

Is Merrick’s card an instant approval credit card?

Fortunately, the approval process for a doubleyourline card is rapid. You can also check your pre-qualification online and get results within minutes. Moreover, this is not damaging to your credit score at all.

Does Merrick’s credit card charge an annual fee?

Yes. The annual fee here can be pretty hefty. Merrick card charges an annual fee of up to $72. Besides this, there is a one-time account opening fee of $75 and a very high APR of 27.7%.

Where are the headquarters for Merrick Bank located, and who owns it?

The main office is at 10705 S Jordan Gtwy, Ste 200, South Jordan, Utah 84095. Other than that, you can also contact the primary merchant division that is present in Woodbury, New York.

Is Merrick Bank legit and safe to use?

It is a legitimate financial company that issues credit cards of all types. Merrick has more than 3 million active users and is playing a considerable role in helping them rebuild their credit over time.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.