If you are looking for a perfect cash-back rewards card, it is the best you can get at Getfreedomunlimited.com! We were amazed to find out that for a card with a $0 annual fee! What’s more? Let’s find out!

- Chase Unlimited Freedom credit card is a no-annual fee card for good to excellent credit scores that offers excellent cash backs.

- The credit card has a variable APR of 20.49% to 29.24%.

- You can apply for the card with a pre-approved mail offer by entering 12-digit invitation number and 5-digit Zip code.

…and Much More!

Getfreedomunlimited.com invitation number lets you get your hands on a Chase Freedom credit card with a perfect sign-up bonus and cash-back rewards that can be redeemed ANY TIME you want.

Note that a special offer is going on for Unlimited Matched Cash Back! You can use the card for all the purchases, and at the end of the year, the bank will automatically match the cash back you have earned (and there is no limit to how much you can earn!).

Chase Freedom Credit Card Reviews

- $0 annual fee

- cash back rewards

- rewards without expiration date

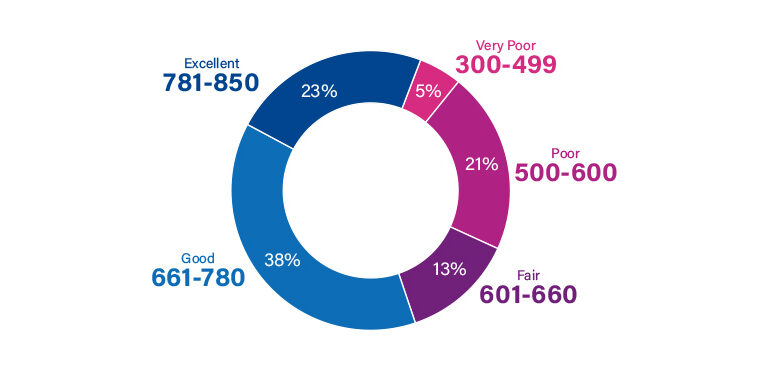

- Credit Score 350 – 850

Required Score: Good To Excellent

Annual Fee: $0

Purchase APR: 14.99% to 23.74% (Variable)

You will be delighted to learn that Chase Freedom does not carry any annual fee.

This makes it even more lovable by customers who want to enjoy its rewards program without worrying about hefty charges at the end of the year.

Moreover, Chase Freedom Unlimited offers a credit limit of $500 for everyone approved, but you can score a much higher limit if you apply with an outstanding credit limit. Chase Freedom and Chase Freedom Flex have announced the categories 2023, including Amazon.com, Lowe’s, gas stations, and more.

Fees and Interest Charges

The credit card has a variable APR of 20.49% to 29.24%. These figures indicate that you can get in trouble if you don’t make timely payments or carry too much debt.

However, besides the purchase APR, there are a few fees that you should be concerned about. Luckily, the card has no maintenance charges or separate fees for account set-up.

It has a Chase Freedom unlimited foreign transaction fee of 3%, but you do not need to consider this if you are not planning on using the credit card.

How To Apply For The Card

Applying for a Chase Freedom credit card is easy if you receive a pre-approved mail offer. The letter will include all the necessary information to complete the application online.

Note! Remember that only legal residents in the US who are above 18 years of age can apply for this credit card. It would help if you also had a good to excellent credit score.

Visit www.Getfreedomunlimited.com and provide the 12-digit invitation number and a 5-digit Zip code. The application requires entering your last name before clicking on Submit.

The bank will get back to you within a week and inform you of their final decision. If you are still waiting to receive an update in 10 to 14 days, it is best to contact the bank’s customer support service and inquire about your credit card status.

What To Do In Case Your Mail Offer Is Missing

You can also apply for the same credit card without any pre-approved mail offer. This would require you to visit the official website mentioned above.

You can check for your pre-qualification status or apply for the card by filling out an online form. Luckily, Chase also accepts credit card applications via phone call.

Why Should You Choose Getfreedomunlimited.com Offer?

Now that you have a better understanding of the expenses involved in managing this credit card let’s look into why you should or should not apply for a Chase credit card.

Amazing Cash Back Offers

The most significant advantage of owning this card is that you can avail countless cash-back offers.

You can avail 5% cash back on travel purchases, 3% on drugstore purchases, 3% when dining in restaurants, and 1% on all other eligible purchases.

Rewards With No Expiration Date

Chase Freedom Unlimited credit card offers you cash back without any expiration date. This means you don’t need to tire yourself with the worry of redeeming the amount. You can do that whenever you need it the most.

There Is a Sign-Up Bonus As Well!

What’s more? You can avail the sign-up bonus with Getfreedomunlimited.com.

As soon as you spend $500 within the first 90 days of becoming a cardholder, you will be given an instant $200 cash back. This perk must be added to most other high-end credit cards.

There Is No Annual Fee!

When you are talking about a credit card with a unique rewards program and flexible application process, the applicants are often disappointed to find out that it also carries a hefty annual fee. Luckily, Chase Freedom has a $0 annual fee!

Insurance and Protection Benefits

When you book cars via this credit card, you will have coverage in case of theft or damage.

On top of that, any other item purchased via Chase Freedom Unlimited can be returned within 120 days and reimbursed with up to $500 per claim.

Furthermore, travel booking and purchases come with cancellation and interruption insurance. This means that if any circumstances occur under which you have to cancel the trip, the expenses will be covered and reimbursed automatically.

0% Introductory APR on Balance Transfers

For a card that has it all, Chase Freedom Unlimited missed out on providing the cardholder with one of the most sought-after perks.

0% introductory APR on balance transfer proved beneficial when you wish to get rid of a debt quickly. However, in this regard, a Chase credit card would be useless.

Extra Reading

Alternative To Chase Freedom Unlimited: Chase Freedom Flex

Both Freedom-branded cards have a $0 annual fee and fantastic cash-back offers. However, what you can earn in rewards varies.

For example, Chase Freedom Flex offers 5% rewards on quarterly rotating categories, and Chase Freedom Unlimited offers 1.5% on “everything else”. The latter’s bonus is capped at $1,500 per quarter in spending before reverting to 1% cash back. The reward system for Freedom Unlimited is more straightforward!

Another fundamental difference is that Chase Freedom Unlimited is powered by Visa and MasterCard powers Chase Freedom Flex. Although both types are widely accepted, MasterCard has additional perks.

Is Getfreedomunlimited.com Legit and Safe?

Chase is a legit platform that has issued credit cards to millions of users around the US. Getfreedomunlimited.com is just one of its channels, whereas the bank offers multiple other cards.

Suppose you are worried about the authenticity of the credit card or their online portal. In that case, you can always contact their customer support team to gather more information. However, we are willing to testify that Chase Freedom is a reliable and trustworthy credit card option.

Getfreedomunlimited Contact Phone Number

Chase needs to include an online chat feature on its website, making it difficult for customers to respond quickly to their simple questions.

Nonetheless, it has maintained a commendable customer support service for many years, so it was rated 4th out of 11 credit card issuers in a customer satisfaction survey.

If you have any queries, call Chase Freedom’s credit card at 1-800-432-3117 to contact one of their representatives. The same line can be used to report a stolen or missing credit card.

The Bottom Line

If you are facing a situation where you need to choose one credit card with an excellent credit score, Chase Freedom Unlimited is a reliable choice.

You can win plenty of cashback every month, and you will not have to deal with any annual fees or maintenance charges. The cashback you collect has no expiration date, so you can redeem the amount any time you wish.

Luckily, the application process is easy as you can apply online or through the phone. What are you waiting for then?

Frequently Asked Questions

Can I quickly get approved for the Chase Freedom Unlimited card?

The required credit score for this card is good to excellent. You may also get approved with a slightly lower score, but that would depend on your creditworthiness. If you have a high income and not a lot of debt shown on your credit report, your approval odds will be increased.

Is Chase Freedom a sound card?

If you are looking for a card with fantastic cash-back rewards, this one will be the best choice. You can avail 5% cash back on travel purchases, 3% on drugstore purchases, 3% when dining in restaurants, and 1% on all other eligible purchases.

Does Chase Freedom Unlimited offer a good credit line?

The credit line that you are approved for will be confirmed once your application is accepted. If you qualify for the primary platinum card, the minimum credit line would be $500. However, if approved for a Signature Visa card, you can enjoy a minimum credit limit of $5,000.

How can I apply for a Chase credit card?

All Chase credit cards are available on their official website. The bank also sends out pre-approved mail offers to eligible customers. If you have received any such letter, you can quickly complete the application by providing the invitation number and Zip code.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.