When you are applying for a credit card or a loan, you would frequently come across the term, what is APR.

However, that is not the only thing you need to know about it.

What’s more? You will find it all here!

What Is APR? Explained In Simplest Words!

It is the annual rate that you need to give to the lenders when you have borrowed funds from them in form of card or a loan.

The rate that would be disclosed to your at the time of approval would include additional costs such as transaction fees, penalty charges, etc.

If we are typically talking about credit cards then APR and interest rates are one and the same thing. Consequently, it can have big impact on how much you need to pay to the bank if you carry balance on the card from one month to the next.

Why Is Annual Percentage Rate So Important?

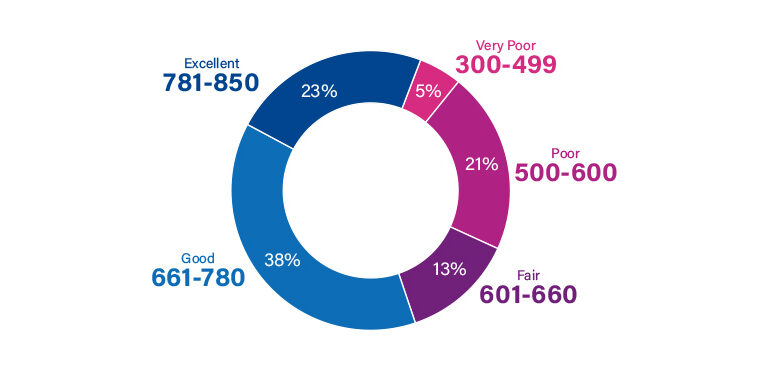

It is very important that you look into APR associated with a credit card use before application. Furthermore, you should try to qualify for lowest APRs if possible although that largely depends on your creditworthiness and score.

Annual Percentage Rate gives you a good idea about the worth of different credit cards as compared to one another.

For example, some cards may carry many catchy rewards but come with hefty interest charges that would just make them difficult to maintain.

Generally, APRs can be avoided by making timely payments and preferably in full but if you want to stay away from any complication, it is best to opt for cards that carry interest affordable for you.

What Is APR Types That You Can Encounter

So far we have talked about APR as a single term. However, this percentage rate can be of different types. Let’s discuss them shortly.

Variable APR

As the name suggests, variable APR can change. They are often listed as index interest rate with lowest and highest window. They depend on the prime rate so if that figure changes, so would the annual percentage rate.

There is no way to predict whether the APR should fluctuate in your favor or not. If you are lucky, the interest rate can be lowered but there is an equal probability of their increase as well.

Many customers view this as a major downside when applying for cards that have variable APR instead of fixed. The only safe side is that you keep in mind the highest interest rate that may apply if you are approved for the credit card.

Fixed APR

On the other hand, fixed APR does not change regardless of the index. Therefore, these are more predictable and can help you decide the budget accordingly. Typically, APRs on personals loans and mortgages are fixed.

Purchase APR

It is the interest you would have to pay whenever you make a purchase via credit card.

Introductory APR

Introductory APR is the same as purchase APR i.e. it is applicable on the purchases made via credit card but in some cases it can be different in the initial 15 months or 21 months.

Some lenders lower the introductory APR or completely free users of it known as grace period. $0 introductory APR can be a great way to get rid of debts when you have just started using the card.

Cash Advance

This is the interest you have to pay when you use the card to withdraw cash.

Penalty APR

Penalty APR is one of the most important type of interest charges that you would have to deal with. This is the amount you pay when you are late with monthly bills or could not pay the amount in full.

Balance Transfer

Some cards allow you to transfer balance from one account to another. The fee charges in this case is known as balance transfer APR.

Can You Calculate It On Your Own?

It may sound a bit complicated but you can quite easily calculate the APR of a loan or a fee. Here are the steps that you need to take.

- Sum the total interest and origination fee.

- Divide the answer by the amount of loan.

- Divide it by loan term.

- Multiply the answer by the number of days in the year.

- Multiply the final answer by 100.

Take-Home Message

Having a good understanding of what is it and how it works can help you decide the right credit card or loan for yourself. You can use the information to compare different offers and also understand how to qualify for lower APR.

Keep in mind that it is very easy to avoid a number of APRs that we have talked about above. For example, you don’t have to worry about penalty charges if you make monthly payments on time.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.