Prepaid cards have made life much easier. You get the card, deposit money, &start your shopping spree right away.

This leaves us wondering, if you avail good reloadable prepaid cards with no fees that will minimize the expenses you have to face when you start using the card.

First of All, Let’s Talk About What Prepaid Cards Are!

People who have been using debit cards will understand how prepaid card are similar as well. The only different is that the latter does not need to be connected to a bank account.

You can visit a merchant store to get your card reloaded. Then you can utilize it to buy goods and services as per your need.

The charges will be deducted from the balance on your card. On top of that, you can also share this money to somebody else’s account. This is how it’s done:

- Input card number.

- Enter one-time PIN.

- Mention the amount that you wish to share.

How Do Prepaid Cards Work?

A prepaid debit card lets you load money either by adding cash or making a direct deposit through a local retailer. You can choose how much funds you wish to add.

Then you can use this card to make purchases online or in-store. Some issuers also allow users to withdraw money at an ATM.

They let you win rewards, share money with friends and relatives, and also put some funds away for saving.

In a nutshell, prepaid cards let you do a lot of stuff that otherwise would require you to own a bank account.

Therefore, if you have not been approved by a bank because of your credit history then a prepaid debit card can serve as a great money management tool.

Are These Different From Credit Cards?

If you have read thoroughly what we have discussed above, you will be clear on this point by now: Prepaid cards and credit cards are poles apart.

Users can say that debit cards are similar to prepaid ones considering they both need pre-deposited funds before use. However, credit cards work entirely differently.

The only thing a prepaid card or credit card can have in common is their appearance. But, that’s about it!

Since same issuers give out prepaid and credit cards, the presence of a logo can confuse the users but that does not imply that the cards are similar in any way.

Are There Reloadable Prepaid Cards With No Fees?

You can find different kind of reloadable prepaid cards in the market issued by different companies with variable terms and conditions.

The Best of Reloadable Prepaid Cards With No Fees

You will come across several suitable options when exploring the market.

However, you should choose depending on how much money you wish to deposit and how you aim to use the card later on.

You can make direct deposit, get a pay roll, ask friend for a top-up or attach cash to your card although the last approach would cost you a bit. Another method is to make a Paypal transfer or send money using account number and routing number.

Below are some of the good prepaid cards that you should consider.

Starbucks Rewards Visa Prepaid Card – No Fees

- Accepted nationwide

- No expiry date

- Star rewards program

Card Purchase Fee: $0

Monthly Fee: $0

Reload Fee: $0

ATM Withdrawal Fee: N/A

Prominent Features

- It is accepted at all locations where a VISA card is applicable.

- It lets you win rewards in form of Star on different purchases. You will earn 1 Star for every purchase under $10.

- You can redeem 25 Stars as $250 spending on your card.

- The rewards do not expire as long as you keep your account open.

- You can not make ATM withdrawals using this card.

- You need a minimum load of $25 to open the account.

American Express Serve Cash Back – Cash Rewards

- Cashback rewards

- Direct deposits

- 90-day purchase protection

Card Purchase Fee: $3.95

Monthly Fee: $7.95

Reload Fee: $3.95

ATM Withdrawal Fee: $2.5

Prominent Features

- 1% cashback reward on every eligible purchase.

- The rewards are redeemable at any time.

- Allows direct deposits with no additional charges.

- Purchase protection is applicable for first 3 months.

- The lowest credit balance allowed is $800.

Note! The monthly fee in case of American Express Serve prepaid card is waived off in TX, VT, and NY.

Netspend Visa Prepaid Card – Direct Deposits

- Allows direct deposits

- Widespread reload locations

- Impeccable mobile app

Card Purchase Fee: N/A

Monthly Fee: $0 to $9.95

Reload Fee: Up to $3.95

ATM Withdrawal Fee: $2.5

Prominent Features

- Works 2 days faster as compared to direct deposits.

- Reload locations are widespread with more than 130,000 available spots.

- It lets you receive funds from friends and families.

- Netspend mobile app to manage your prepaid account easily.

- You can earn cashback on eligible purchases and get a bonus as well.

- You will be charged extra fee of $5.95 if you leave the card inactive for 3 months.

Attention! Netspend prepaid card offers two different types of subscription plans. You can choose Pay-As-You-Go with charges no monthly fee and $2.0 for PIN transactions. The other plan is Premier Fee Advantage which has $9.95 fee per month with transaction charges included.

PayPal Prepaid Mastercard – No PIN Transaction Fees

- Easy fund transfer

- FDIC insured

- Cashback rewards

Card Purchase Fee: N/A

Monthly Fee: $4.95

Reload Fee: N/A

ATM Withdrawal Fee: $0

Prominent Features

- Allows transfer of funds from Paypal card to bank account.

- Allows for direct deposits that works faster than paper check.

- Lets you earn cash back in form of reward points.

- Insured by FDIC which means your funds are safe and can be used anywhere a Debit Mastercard is accepted.

- Paypal mobile app is available on the go to help you make transactions, load funds, check balance, etc.

Bluebird By American Express – Budgeting Features

- Easy to load

- Free ATM withdrawals

- Allows 4 subaccounts

Card Purchase Fee: $3.95

Monthly Fee: $0

Reload Fee: $0

ATM Withdrawal Fee: $0

Prominent Features

- The card is issues by American Express in partnership with Walmart.

- Cash reload is possible in a number of ways and at widespread locations without any charges.

- Allows free transactions and free ATM withdrawals.

- Allows you to enter up to 4 subaccounts for your kids or spouse.

The card is not accepted at some locations.

What’s More You Need To Know About Reloadable Prepaid Cards and Their Use

Prepaid Card Benefits and Features

Prepaid cards are amazing and everything but are they meant for everyone? It is always a good idea to explore what such cards offer to decide if you need them or not.

The first thing to keep in mind is that although prepaid cards are different from debit cards, they both work quite similarly.

Once you exhaust the funds they you deposited on the card, you are done! Obviously, unless you top it up again with more funds.

Prepaid cards have protection feature similar to credit cards. This is necessary because prepaid cards are meant to be used for daily purchases such as grocery and other things.

Note! Prepaid cards do not need to be linked to checking account or any other bank account. Nonetheless, they possess routing and account number to make it easier to deposit funds.

Moreover, quick credit rebuilding will require you to apply for credit cards instead of prepaid. However, you can use it to budget your expenditure and save enough money to apply for a good secured card later on.

One of the best parts about prepaid cards is that they are widely available from local stores to supermarkets.

You can also get it reloaded at various locations. Just make sure you watch out for some surprise fees associated with a few prepaid cards.

To sum it up, here are a few benefits associated with prepaid card and its use.

- Help you maintain spending budget by keeping your limit in view.

- Easy to obtain at number of stores and easy to reload as well.

- You don’t need a credit history or employment verification to apply for it.

- It does not allow you to spend over-limit so you can not incur debt.

- You can pay utility bills, grocery and bills at gas stations.

Prepaid Card vs Gift Card

Just like that with credit card, there is not much common between a prepaid card and a gift card. Gift cards are for specific use. For example, a Walmart card can not be used to make a purchase anywhere else.

You can purchase gift cards using a checking account or you may receive reloadable gift cards with no fees elsewhere such as part of a contest win.

Gift cards often have a limited time offer. You are supposed to use them till a given date. On the other hand, prepaid cards do not have an expiry date.

Prepaid Debit Card vs Regular Debit Card

Before you start using prepaid cards, you should know about the similarities and differences between a normal prepaid card and institutional debit card.

Let’s talk a bit about a regular debit card first.

This type of card needs an associated bank account. There are only a few stores that offer debit cards. Prepaid card, on the other hand, does not require an account.

Note! Prepaid cards typically come with more fees as compared to regular debit card.

Both of these cards work with pre-loaded money that you need to deposit before use. You can not spend money more than what you have loaded on to the card.

Prepaid Card As Bank Account

You can view prepaid card as a bank account where you have deposited money that you can use on the go until the balance runs out.

However, alternative to prepaid cards that are issues by bank institutes themselves are known as debit card. Although they operate similar to prepaid cards, there are some basic differences.

Attention! The biggest similarity between prepaid card and debit card is that both of them need the user to deposit money before use. They also do not offer over-the-limit money loan.

“But prepaid cards also come with routing number and account number.” Yes! They do. However, none of them can be used to build credit history or improve credit score, at least directly.

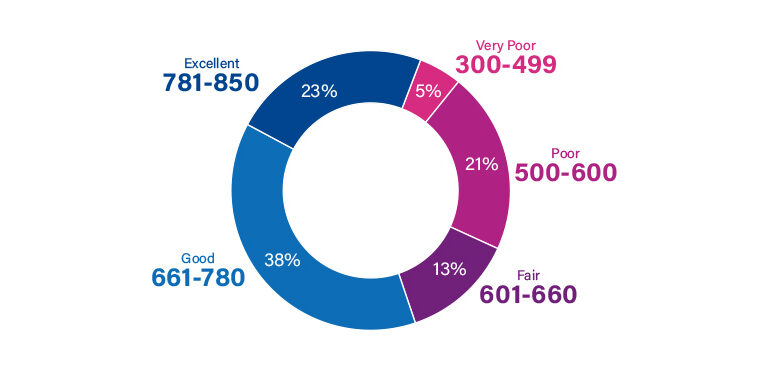

Pro-Tip! If fixing a poor credit score is your main goal, you should invest in a secured card. There are some instant-approval credit cards that report to all major credit bureaus and help improve the look of your report.

How To Decide If You REALLY Need a Prepaid Card

There is no doubt that prepaid cards have become quite popular in the recent years. In fact, their use have almost doubled from 2012 to 2014.

They have eliminated the need of owning a bank account to get hold of a card. This contributes a lot to the fact that almost 8.4 million US residents do not have an account since 2017.

However, it would not make sense to apply for the card just because your friends are doing so. You must acknowledge your own convenience and need to determine whether you need a prepaid card in your wallet or not.

According to Ted Rossman, an Industry Analyst, prepaid cards have proven to be most successful for students and new-comers without credit cards.

That is because parents can easily share money to their kids since they don’t own credit card or a bank account. This will prove to be quite helpful before they can apply for a “real” card.

Steps To Take In Case You Lose Your Prepaid Card

Losing any sort of card, whether prepaid or credit card, can have serious consequences especially if you fear that your PIN has been leaked or it’s easy to guess.

Therefore, it is smart to immediately contact the service provider and request for deactivation. Some companies allow this service to be availed online. Otherwise, you would have to visit their office in person.

If you opt for a prepaid card replacement then there might be a small fee for the new card. You can then transfer the funds you had in the old cad to the new one almost immediately.

The bottom line here is: JUST DON’T lose your card. Some of the more careless customers should always go for a PIN that is strong and hard to guess.

Getting An Overdraft With Prepaid Cards

Most prepaid cards only let you use what you have on the card and there is no room for spending over-limit. Once you have exhausted the funds, you can continue using the service unless you reload again. You can do that online or visit the office of service providers to deposit more funds on to your card.

Attention! There needs to be an agreement between you and the card issuer if you wish to avail overdraft services.

This means only then would you be able to borrow money and pay it back later like a credit card. In most cases, this is only allowed if you have good financial records.

Fixing Credit Score With Reloadable Prepaid Card

Now this is an important point to discuss especially because when we were talking about credit score rebuilding above, we mentioned that prepaid cards can not help you build credit score DIRECTLY.

This does not mean they are completely useless when it comes to improving your finances.

Prepaid cards can not help you improve your credit report because technically, the don’t have any credit line associated with them. Such cards do not require a credit history or financial record. You get the card from a store, fund it with money, and use it till the balance expires. It’s simple!

As you can see, there is no credit relationship, no reporting to credit bureaus, and no consideration of your credit score.

That being said, there’s a lot that prepaid cards can do for your credit score indirectly. For example, such cards are great for money management.

You can load the amount that you have to spend by the end of the week and then track your spending so you don’t end up with a disturbed budget.

Some companies that issue prepaid-cards also let you create sub-accounts. You can make a separate account for your kid or spouse and load the funds that you have to provide for them.

In a Nutshell

Prepaid cards are very helpful.

They let you carry around cash without actually keeping it in your wallet (Nobody is up for that risk in 2023!). You can use it to make emergency payment, pay utility bills, etc. These also come with protection features to restore money in case you lose it.

Moreover, there are a number of reloadable prepaid cards with no fees that let you enjoy benefits of prepaid card without additional charges. They are very light on your pocket and let you make payments internationally as well.

Hopefully, you can find the right card for yourself in the options we have discussed above. Keep us updated about your experience in the comment section below. Good Luck!

Frequently Asked Questions About Reloadable Prepaid Cards With No Fees

What is the best reloadable prepaid cards with no fees that I can apply for?

American Express Serve is one of the best options you will find in the market. You can read more about its perks in the article above.

Will I charged extra when I reload my prepaid card?

This is not true for all prepaid cards. For example, American Express Serve does not charge any fee for loading the card with funds. On the other hand, there are a few prepaid cards that can cost up to $4.95.

What is the limit on daily load you put on prepaid card?

Technically, there is no limit and the specific amount would depend on the service that you are using. Some cards allow reload of $500 whereas there are other that let you reload up to $10,000.

Can I use ATM to reload my prepaid card?

You can deposit funds on to your prepaid card by using many different types of services. This also includes transferring funds from an ATM. You will need to provide the secret PIN for this service.

Can I use my prepaid card to transfer funds to a bank account?

Yes. You can move money from prepaid card to bank account by opening its website and entering the amount you wish to transfer. In case, your prepaid card does not allows this exchange, you can use a third-party service such as MoneyGram to proceed with this.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.