Preapprovedtotal gives you access to Total Visa credit card that is a perfect choice for anyone who either has an average score or is currently struggling with poor FICO score.

Luckily, you don’t need to wait for pre-approved mail offer to apply for the card. You can simply fill out an easy and quick application online to get the job done.

What makes Total Visa credit card special? Let us show you why you should definitely consider this card if your aim is to boost your credit score fast.

Total Visa Credit Card

- No initial deposit

- Very fast application

- Supports poor credit score

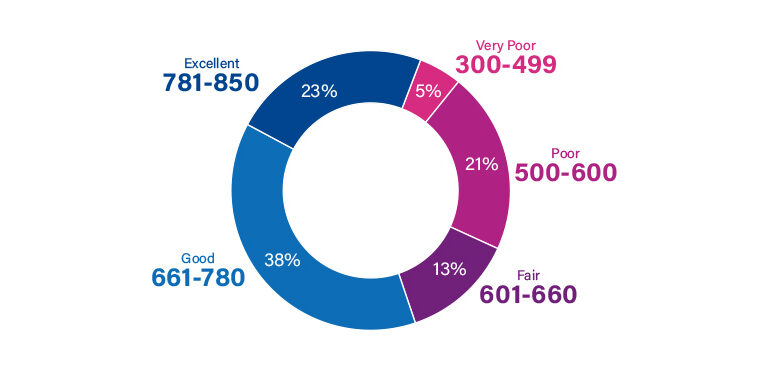

- Credit Score 300 – 850

Required Score: Average

Annual Fee: $75

Purchase APR: 34.99%

The first that you need to consider when responding to Preapprovedtotal is whether or not you are ready to deal with expenses that come with the card.

Is Total Visa Credit Card Expensive?

Once you are approved for the credit card, the bank will ask you to deposit a fee of $89 to open your account. Initial setup fee is not common to all credit cards. There are many issuers who do not charge this fee at all.

On top of that, cardholders also have to pay $75 after the first year of using the card. The annual fee then jumps to $123 after 2 years. This fee is considerably higher when compared with other competitive cards in the market.

You have to pay an additional fee of $29 when choosing another authorized user. Such a user can not earn you extra rewards or help you score any more benefits therefore we recommend customers to not add anyone unless it is truly required.

Note! Total Visa credit card has $3 fee if you want to pull out a duplicate of your account statement.

What About Interest Charges?

Unfortunately, Total Visa card does not go easy in terms of APR as well. It has an interest rate that starts at 34.99%. This mean you could end up with a lot of debt if you fail to make timely payments every month.

Lastly, this card allows a restricted credit limit of $225 for customers with poor credit score. This maybe increased depending on your creditworthiness but if we compare the minimum credit line, it is much less as compared to other unsecured credit cards for people with average scores.

Why Should You Choose Total Visa Credit Card?

It Does Not Require Perfect Credit Score

There are not many good credit cards present for customers who have less than average score. Total Visa credit card aims to change that picture by offering approval even with a fair credit score. In fact, applicants with poor score have been accepted as well considering their creditworthiness and history.

It Allows For Credit Rebuilding

This card gives you access to a credit card that can help you improve your credit score fast. Total reports to all three major credit bureaus. Therefore, if you maintain good spending habits, you would soon be able to boost the look of your credit report.

Quick Application Process

If you have received the mail offer, there is no need to complete the entire application form online. You can simply enter the confirmation number and apply for the credit card within minutes.

$0 Fraud Liability

The card has you covered in case you lose it or it is stolen. Total would not charge you for any unauthorized transactions. You should immediately report the bank if any such event takes place.

It is an Expensive Choice

Total Visa card is meant for users who wish to improve their credit score before they can apply for high-end, rewards credit cards. However, in order to do so, you have to be on your best behavior since the card carries a high interest rate and penalty fees as well.

It Has a High Annual Fee

Most unsecured credit cards have annual fees but in case of Total credit card it is set at $75 which is considerably higher than other options. The annual fee is deducted from your credit limit. Since the card also allows for low credit line only, it means you will be left with a very small amount to spend during the month.

How To Respond to Mail Offer

Total now provides easy application to its loyal, interested customers by giving them a chance to apply via pre-approved mail offer. Although such offers do not guarantee that you would be accepted as cardholder at all costs, it simplifies the process considerably.

If you are interested in becoming a Total Visa credit cardholder, simply check your mail letter for the Preapprovedtotal.com reservation code. Visit their official website at www.preapprovedtotal.com to enter this number and quickly finish the application.

Once you have submitted the application, you should wait at least 7 to 10 working days to hear from the bank.

Steps To Take In Case Your Mail Offer Is Missing

Getting a pre-approved mail offer really shortens the time it takes to apply for the Chase credit card. However, it is not the end of the world if you did not receive the offer!

There are multiple routes you can take in order to continue with card application if you had not received the mail offer. Simply visit their official website and apply for the card by providing your personal information.

Is It Safe For You?

Furthermore, their contact service is readily available and you can always get in touch with their team to discuss your queries.

How To Get In Touch

You can get in touch with their customer support team by calling (877) 526 – 5799 or leave an email on the official address [email protected].

In case you want to send in a written query, kindly use the following postal address:

Total VISA P.O Box 84930 Sioux Falls, SD 57118 – 4930.

Final Words

Total Visa credit card is an amazing option for those who do not have a perfect credit score and therefore can not qualify for high-end credit cards. It has also become customer’s favorite as it allows for quick application and approval.

If you are approved, the card and other credentials will be at your doorstep in less than 10 days.

However, you need to keep in mind that the card does carry high interest charges as well as an annual fee. If you want to make the most out of Total Visa credit card and improve your credit score, you will have to be on your best behavior and make sure you never miss out on a payment. Best of Luck!

Frequently Asked Questions

Is Preapprovedtotal legit?

Total credit card and are completely reliable services that you can trust with your eyes closed. The bank has provided cards to millions of users around the US and it is currently one of the best known credit card issuers.

Is it possible to increase credit limit with Total Visa credit card?

You need to keep the account open and active for at least a year before you are eligible for a credit line increase. Moreover, the bank also charges 20% of the credit limit as a fee when the line is increased. This means $20 behind every $100 increase.

When will my Total credit card reach me?

First you need to wait for the approval mail. Once you have been accepted as a cardholder, the bank will ask you to pay the program fee. After that the credit card will reach you within a week or in 10 days.

Can I get approved for Total card easily?

Yes. This credit card has been ranked as one of the easiest cards to get approved for when applying with an average credit score. It also offers quick application process and instant response to make your experience even better.

Which bank issues Total credit card?

The card is offered by the Bank of Missouri that reports to all three major credit bureaus. Therefore, it is a reliable option if you wish to improve your credit score fast.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.