Getting approved for a sound credit card with an average score is no longer a problem. IndigoApply.com invitation is here to add to the ease of becoming a cardholder.

Is this card a good choice for those with poor credit scores? The truth is that Indigo would even take care of those users who have faced recent bankruptcy!

- IndigoApply is a pre-approved mail offer that can cut short credit card application and save your time.

- Indigo Platinum Mastercard is a perfect credit card for those with poor credit score who wish to improve their credit standing.

- The card has affordable annual fees, $0 fraud liability, and reports to credit bureaus about your spending behaviour.

…and Much More!

Indigoapply.com – Everything You Need To Know

What sets apart Indigo Platinum Mastercard? There are so many credit cards to choose from, so why should you go for Indigoapply? We will tell you why.

The Indigo Mastercard can be used at more than 35 million global locations. Moreover, it is easy to apply for this card, especially if you have received an online mail offer from IndigoApply, Getmyoffer. Capitalone & Doubleyourline.

First of all, it is an excellent card if you wish to enjoy a safe experience. The Indigo Platinum Mastercard provides coverage for your debts. It guards your credit card service, Email IDs, passwords, and other confidential statements you share with the bank.

What’s the worst that could happen? Your card gets stolen! Even in this case, there is no need to hesitate. There is a $0 fraud liability for all unauthorized transactions, which means you will not be held accountable for any purchases.

- The next perk is that they have a very user-friendly online account. You can set it up and access it as soon as you are approved and receive the card.

You can also opt for cash advances at any financial centre, regardless of your state. The possible advance amount would depend on your credit worthiness and limit.

Indigo Platinum Mastercard at Indigo Apply – In a Nutshell

There are many things you need to know about this card before applying. For example, it can prove to be costly monthly compared to other credit-building cards in the market.

The good side is that you can apply for a low annual fee. This depends on your creditworthiness. Additionally, the qualification and application process is easy and fast.

If you proceed to check for pre-qualification, it will not hurt your credit score. While choosing the card, you can pick from several available designs.

Once your application is approved, you can immediately set up a mobile account to keep a check on your transactions. This service is available throughout the day without any additional charges.

IndegoApply at a Glance

- Easy and quick application

- No security deposit

- Good credit limit

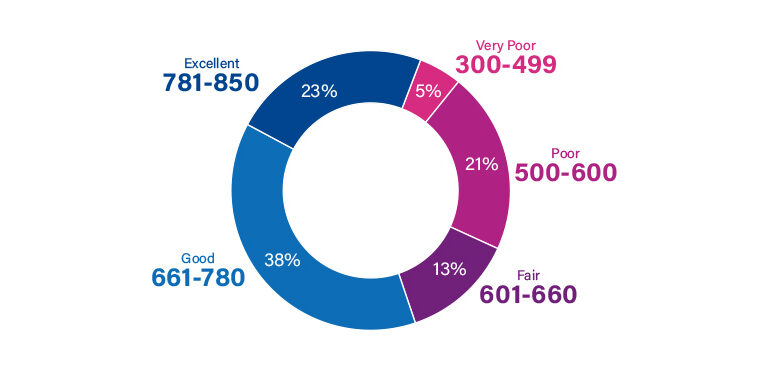

- Credit Score 350 – 850

- Required Credit Score: Fair

- Annual Fee: $0 to $99

- Regular APR: 24.90% (non-variable)

You might be wondering why this card card charges such high fee. The reason is that most unsecured cards do it because they are not taking any deposit from you as security.

How To Respond To Mail Offer From www.IndigoApply.com – Step By Step Guide

Applying for Indigo Mastercard is one of the most straightforward tasks you can complete in a minute. The job is made even smoother in case you receive an online mail offer.

Were you one of the lucky recipients? Great! Here’s what you need to do next.

- First, open your web browser and type in www.indigoapply.com for login. This is the official website where you need to provide details for Indigoapply credit card application.

- After logging in at Indigoapply, the page will ask you to fill out two critical fields: zip code and an invitation number.

- The invitation number is a 12-digit code that would be given on the mail offer that you just received. The process will take less than 3 minutes to be completed.

- What’s next? You wait! If your application is accepted, you will hear from the bank within a week.

- If rejected, you will be notified via email of the reasons behind disapproval.

There is also a scenario in which you might not get to hear from the bank at all. This means that the decision regarding your application form is still pending. You can wait a few days before calling and contacting a representative to request them to review your Indigoapply application.

Steps To Take In Case Your Mail Offer Is Missing

It would have been great news if you had received a pre-approved mail offer, but there is nothing to worry about if you have not. There is another way in which you can check for eligibility for getting a mail offer.

- To do that, you need to visit www.indigoapply.com. Here, you can locate the button “See if you are pre-qualified.”

Clicking on this tab will take you to a digital form. Here, you must provide your full name, suffix, residing address, city, state, zip code, date of birth, social security number, email address, and phone number.

After entering all the information, click submit, and you will be notified within minutes whether you pre-qualify for the offer.

You can immediately contact their lost/stolen department for help if you notice a delay. This is possible by calling at 1-888-260-4532.

The Bottom Line

Indigo credit card is a great option to rely on if you are looking for a tool to improve your credit score. Look at how easy the application process is, and that’s why we suggest you go for it immediately!

- The credit card is excellent for showing the credit bureaus that you are a responsible cardholder. This would eventually let you fix the poor credit score over time.

Although some fees are involved, the card’s long-term gain is praiseworthy. There is one important thing to note here! It does not matter if you get your hands on one of the best credit cards; these would be useless if you don’t remember to make timely payments.

You might be interesting in reading: Checking Account For Bad Credit Score.

Frequently Asked Questions

Is Indigo a real and legit credit card company that is safe to use?

Yes. The company is entirely reliable. It offers sound, unsecured credit cards for people with less than-average or poor credit scores. Moreover, their annual fees are affordable, and these cards can help you build your credit score over time.

Will Indigo perform a hard check on my credit report?

Indigo will pull hard on your credit report if you apply for a credit card immediately. However, if you check pre-qualification, then that would only result in soft inquiry and will not affect your credit score.

What are the fees for an Indigo credit card?

The annual fee is $75 for the first year, increasing to $99 for the rest of the use. There is also 1% on foreign transactions, and a regular APR of 24.9% is applicable.

Can I use my Indigo credit card to cash out at an ATM?

You must insert your card into the ATM and provide your PIN to cash out. Select Cash Advance from the options displayed on the menu, and then enter the amount of money you wish to take out.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.