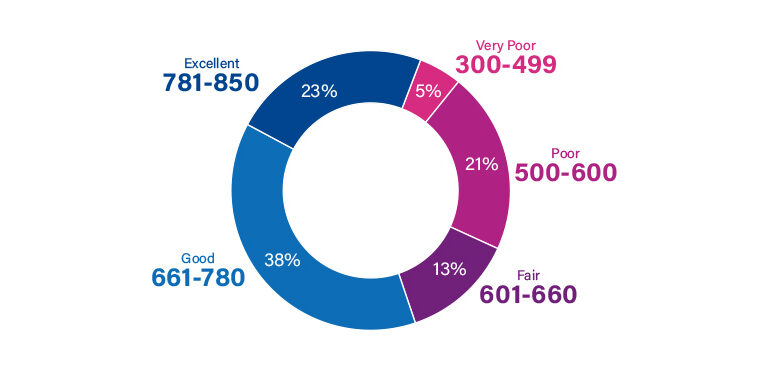

Even those with a perfect credit score did not start there. We all face financial issues sometimes, and a sound credit card can help you deal with them more efficiently. So, if you hear from Accept.CreditOneBank, there are many reasons why you should reply promptly.

- Credit One Bank offers different credit cards suitable for people with fair to good credit score that can help them improve their financial standing too.

- You will need CreditOne bank pre-approval code and zip code to complete the application online.

- You can contact the bank customer support service or tap on their “See Card Offer” option online to check if you are eligible for any pre-approved mail offer.

…and Much More!

Why You Should Choose Accept.CreditOneBank?

When used correctly, a credit card can help you repair your poor credit score. Credit One Bank also holds an impeccable reputation for granting credit cards to average scorers.

Furthermore, these cards come with various rewards such as cashback offers, discounts, bonus points, etc.

If you are committed to becoming a good credit cardholder, Credit One will recognize your efforts, and you might be lucky enough to get an accept.CreditOneBank mail offer.

- Moreover, you have complete security regarding credit card use.

If you lose the card or it gets stolen, the bank would then cover with $0 fraud liability. This means you don’t have to pay for the unauthorized purchases made after the event.

However, one thing you need to watch out for is that most of these cards carry a hefty annual fee. The yearly charges can be as much as $99 for some high-end cards.

What Are Your Options?

From credit scores ranging from excellent to average, Credit One Bank has a little something for everyone! That may be why Accept Credit One Bank.com has gathered good reviews over the years.

You can ensure that by checking out the range of credit cards the bank features.

Credit One Bank American Express Card

Credit One Bank American Express Card

- Low Annual Fee

- Cashback rewards!

- Discounts on Arnex programs

- Score Required: Fair to Good

- Annual Fee: $39

- Purchase APR: 23.99% variable

Why You Should Choose This:

This is one of the best cards offered by Credit One that charges a minimal annual fee. You can also make use of 1% cashback that is applicable on all eligible purchases.

Besides the $0 fraud liability it offers, this fantastic credit card covers you over other damages.

What is that? If you accidentally break, damage or an eligible item is stolen, the credit card’s Retail Protection plan covers you!

It is also compatible with Arnex, which offers programs that get you discounts on shopping, dining, and other entertaining activities.

Furthermore, you can buy exclusive, pre-sale tickets with this credit card for some of the fantastic events around the US.

Credit One Bank Platinum Rewards Visa Card

Credit One Bank Platinum Rewards Visa Card

- 1% cashback on all purchases

- Free credit score check

- 5% cashback on grocery

- Score Required: Fair to Good

- Annual Fee: $95

- Purchase APR: 23.99% variable

Why You Should Choose This:

Platinum Rewards has been one of our favorite credit cards offered by Credit One because of its amazing rewards. First of all, you get 1% cashback on all eligible purchases.

In addition, you will also get to enjoy 5% cashback on the $ 5,000 you spend on different utility bills such as groceries, internet, gas, TV, mobile, etc.

Additionally, you will have free access to Experian credit score if you wish to keep an eye on the improvement that you are making. It features $0 fraud liability, and the cashback you win through the card is redeemable at any point.

Credit One Bank Platinum Visa Card

Credit One Bank Platinum Visa Card

- Cashback rewards!

- $0 fraud liability

- Free credit score check

- Score Required: Fair to Good

- Annual Fee: $39

- Purchase APR: 23.99% variable

Why You Should Choose This:

The most significant advantage of choosing this card is its minimal annual fee compared to other options. In addition to that, it also offers 1% cashback on all eligible purchases.

Like all other Credit One cards, you will be protected by $0 fraud liability. Additionally, you will have free access to Experian credit score if you wish to keep an eye on the improvement that you are making.

Credit One Visa Cashback Rewards credit card lets you choose your monthly payment date. This is a very reasonable feature as different users get hold of their income on varying days of the month and, therefore, wish to choose when to pay for credit card services.

Credit One Bank NASCAR Credit Card

Credit One Bank NASCAR Credit Card

- $0 fraud liability

- Automatic credit line increase

- Customizable payment dates

- Score Required: Good to excellent

- Annual Fee: $0 – $99

- Purchase APR: 17.99% – 23.99% variable

Why You Should Choose This:

Becoming a NASCAR cardholder means you can avail double cashback rewards at the NASCAR shop. The credit card lets you enjoy 1% cashback on all eligible purchases.

Furthermore, it features $0 fraud liability. The credit card providers will run an automatic soft inquiry on your report to see if you qualify for a credit line increase when the time is right.

NASCAR credit card lets you choose your monthly payment date. This is a very reasonable feature as different users get hold of their income on varying days of the month and, therefore, wish to choose when to pay for credit card services.

Lastly, this is a fantastic choice for anyone who wishes to improve their credit score. The process is further aided by an impeccable mobile app that lets you set alarm alerts and check in on account details quickly.

How To Respond to Accept.CreditOneBank Mail Offer

If you were lucky enough to get a mail offer from Credit One Bank, we recommend you respond as soon as possible. This will not take much of your time. You will complete the application process in just a few minutes.

Since you have a Credit One Bank pre-approved mail offer offer, you won’t need to fill out a long form for credit card application.

Luckily, you need to enter the information already given on the mail offer you got for the card application to begin.

To respond to Accept.CreditOneBank mail offer: visit their official page at www.Accept.CreditOneBank.com.

Here you need to enter:

- Credit one bank Approval Code

- Zip Code

Then press the “continue” button, and your request will be forwarded to the bank.

You can keep your hopes high as pre-approved offers mean you have a high chances of being accepted. However, this is not 100% guaranteed.

If it is disapproved, you will be notified via mail. Moreover, you might not hear from the bank if the request is pending. In this case, we suggest you wait a few days.

Steps To Take In Case Your Mail Offer Is Missing

If you have not received a mail offer, it may be because it was sent out randomly to all eligible users. Unfortunately, your name was missing, which is nothing to worry about!

You can contact Accept.CreditOneBank.com and see if you “pre-qualify” for the offer.

The pre-qualification form would also ask you to provide some basic information, including your full name, address, city, contact numbers, Email ID, income, date of birth, etc.

After you have provided all the information, you can click on the tab that states, “See card offers.”

Your request will then be processed immediately, and informed whether you are eligible for the pre-approved offer.

CreditOne Bank Mail Offer – Legit or Scam?

That is a question many new customers worry about. It makes sense because money is involved; nowadays, you can not be careful enough.

However, any old and committed Credit One card user would be able to justify that the bank is a trustworthy platform. All the information that you provide to them is in safe hands.

Credit One Bank also ensures that your credentials are not a wrong third-party. If you successfully get a credit card, it will come with $0 fraud liability if stolen.

How To Get In Touch With Accept.CreditOneBank

Credit One customer support services are available 24 hours a day, 7 days a week. You need to call their toll-free number, 1-877-825-3242.

You can also contact the same number in case your credit card is stolen, or you wish to enquire about your Credit One application approved/disapproved status.

If you want to opt for written correspondence instead, the mailing address is as follows:

P.O. Box 98873

Las Vegas NV 89193-8873

The Bottom Line

CreditOne Bank provides a perfect opportunity for anyone who wishes to improve their poor credit score. Moreover, it gives a hassle-free credit card application with a high chance of approval.

The only thing you need to remember is that rebuilding a credit score is not happy overnight. It requires efforts that must be made a part of your everyday routine. Only then would you see a rapid increase in your score.

Frequently Asked Questions

How does Credit One pre-approval auto loan work?

You only have to sign in using your code and then use the pre-approval letter or email to respond to the auto loan request.

Is Credit One pre-approval guaranteed?

No, it does not guarantee approval. However, you will be saved from submitting a complete form for review. You will only need to enter the pre-approval and zip codes.

What is the credit limit for Credit One pre-approval up to $2000?

$2000 is the maximum credit line for which you may be approved, although no official statement has been given. Credit One applicants can expect a credit line of $300 to $500 initially, depending on their creditworthiness.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.