You can apply for the Citi Rewards Plus card by simply clicking on Apply Now button for pre-approved mail offer and filling the online application at Citi.com/applycitirewardsplus.

Simple and easy! With a good credit score, this is a chance you don’t wanna miss on.

Citi Rewards Plus Card

- 10% points rebate

- 10 points on every purchase

- different redemption options

- Credit Score 350 – 850

Required Score: Fair to Good

Annual Score: $0

Purchase APR: 13.49% to 23.49%

Citi Rewards Plus credit card is a fine choice when you want to spend minimal on maintaining the card but bag maximum benefits and bonus points.

It not only offers a superb sign-up bonus but is also the only credit card in the market that automatically rounds up to nearest 10 points on every purchase.

There are a number of other benefits to discuss that we will shortly do so in the next section. However, before that, let us shed more light on one other important question:

Are The Rewards Here Worth Credit Card Charges?

A piece of good news is that the credit card offers 0% introductory APR on balance transfers and 0% purchase APR for the first 15 months.

Once the grace period is over, credit cardholders have to pay 13.49% to 23.49% variable APR. This amount will vary depending on your credit worthiness.

The balance transfer fee is set at 3% like most other cards. $5 will be charged if that is the greater amount.

Most importantly, the card does not have any annual fee so you don’t need to worry about losing considerable amount of your credit limit to it at the start of the spending year.

Why Should You Choose Citi.com/applycitirewardsplus?

Generous Reward Points

You will win 2 points per every dollar spent on groceries and at gas stations. Other than that, you get to earn 1 points on every dollar spent on all other eligible purchases.

10 Points Per Purchase

This is perhaps the most fascinating feature of the Citi Rewards Plus credit card. It is more commonly known as the round-off feature that ensures you get a minimum of 10 points on every purchase.

When you make a purchase, your points would be automatically increased to nearest 10. For example, if a customer makes a purchase of $4, he will earn 10 points. Similarly, on the purchase of $21, he can collect 30 points.

Welcome Bonus Offer

Although the sign-up bonus offer is not as catchy as compared to some other high-end credit cards, it is still something! You will earn 15,000 bonus points after spending $1,000 in the first 90 days of becoming a cardholder.

These points are redeemable as $150 cash. It is true that this amount is considerable lower than what some other outstanding card issuers have to offer.

10% Points Rebate

If you have made considerable number of heavy purchases with the credit card, you can expect to earn back 10% of the redeemed points at the end of the year for every 100,000 points. This means you have the opportunity to win $100 per year.

However, this is not easy to do in case of moderate spenders. Typically, a credit cardholder can easily earn and then redeem 20,000 points each year. This would means a total of $20 rebate.

Points Redeemable In Different Forms

The points that you will earn are basic Citi Thankyou points that can be redeemed in a number of ways. You can redeem them for travel, statement credit, or as gift cards on the Citi portal.

The bank also allows you to transfer the points to JetBlue’s TrueBlue Rewards program but you will lose 20% of the worth in this exchange since the transfer ratio is set at 5:4.

Spending Cap On Bonus Categories

The bank limits your potential of earning the reward points. It has a spending cap on gas and groceries set at $6,000. This may seem like a lot but if you consider a larger family, this amount can be easily exceeded in a year.

The card’s round up feature is also only beneficial when you have to make small purchases regularly.

You can win at most $100 gift cards by using 10% redemption bonus. Moreover, there is so much math involved if you worry about these points all the time. It is better to invest in a credit card that will let you earn flat-rate bonus points.

Varying Point Values

We discussed about that the Citi bank lets you redeem these points in different ways but the conversion value is not equal. Gift cards are most beneficial as they let you reap the point’s value by maximum rate.

Many customers are inclined to choose cash redemption although it cuts the value of the points in half.

How To Respond To Mail Offer

If you have received the credit card offer in your mail then this is your chance to proceed with easiest card application. All you have to do is visit Citi.com/applycitirewardsplus invitation number and then provide:

- Invitation code

- Last name

Recheck that you have provided the correct information and then click on Apply Now.

Once your application is submitted, the bank may take a week or two to get back to you with their final decision. You can reach out to their customer support service to check the status of your credit card application.

Steps To Take In Case The Mail Offer Is Missing

Pre-approved mail offers are a great way to complete credit card applications in a quick and easy manner. However, banks only send them after a soft inquiry to figure out which users deserve it the most.

Since this is a random process, it is highly likely that you will not receive the offer in your mail. You don’t have to fret. You can still proceed with the application by visiting their official website and applying through usual online application.

Is It Safe For You?

Citi bank is a completely reliable service. So far, it has provided credit cards to thousands of applicants and delivered bonus point benefits as promised.

Furthermore, their contact service is readily available with all the details provided online. If you have any queries or issue with credit card use or application, you can reach out to their representatives for help.

Customer Support Service

For queries you can send a direct message to Citi bank at www.citibank.com.ph.

Besides that, their customer support team is always available at 1-800-842-6596.

Wrap Up

After taking a good look at the benefits and pros of Citi Rewards Plus card available at Citi.com/applycitirewardsplus invitation number, it is safe to say that the credit card is a good choice for moderate spenders or people who often purchase stuff under $10. If you frequently pay for groceries or gas through credit card then this one will prove to be quite handy.

The most classy feature of the card is its 10-points-per-purchase rule. However, this may not seem like much to many customers. After all, each point is only worth 1 cent.

There is no doubt that there are other better choices in the market. Make sure to take a good look at your options before you make the final choice.

Frequently Asked Questions

Is Citi Rewards Plus credit card good for my use?

This credit card can prove to be a really good choice if you frequently make small purchases less than $10. This is because of its round-off feature that ensures you get $10 on every purchase.

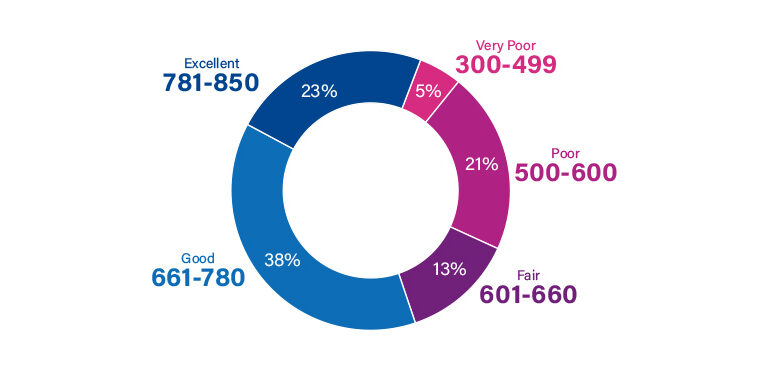

Does Citi Rewards card require good credit score?

Yes. You need good credit score to apply for this credit card. Applicants with score above 660 are most likely to be approved for the card whereas applying with a score above 700 is a sure-way to become Citi Rewards cardholder.

Will Citi perform a hard pull when I apply at Citi.com/applycitirewardsplus ?

Citi bank always uses a soft pull when you initially apply but can perform a hard inquiry when you ask for higher credit limit increase. In case of automatic increase in your credit line, the bank will make use of soft inquiry only.

Can I convert Citi Thankyou points to cash?

Citi bank lets you redeem these points in different ways but the conversion value is not equal. Gift cards are most beneficial as they let you reap the point’s value by maximum rate. Many customers are inclined to choose cash redemption although it cuts the value of the points in half.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.