Customers who are actively looking for a credit card to help them get rid of debt should consider citi.com/applydiamondpreferred.

This portal gives access to Citi Diamond Preferred credit card with 0% introductory APR and 0% balance transfer fee.

It is obvious that cardholder fear interest rates the most. Whether it be purchase APR or interest that they incur on balance transfer or foreign transactions, it’s never a pleasant thought or a treat for their credit report.

Citi Diamond Preferred takes this into consideration by offering its users with good credit score to steer clear of any such fees for the first 18 months.

After that, you would have to deal with the usual 14.74% to 24.74% Variable interest rates.

So what are the benefits that make this card worthy of your application and should you respond to pre-approved mail offer? Let’s find out.

Citi Diamond Preferred Credit Card Reveiw

- $0 annual fee

- $0 introductory APR

- Citi entertainment package

- Credit Score 740 – 850

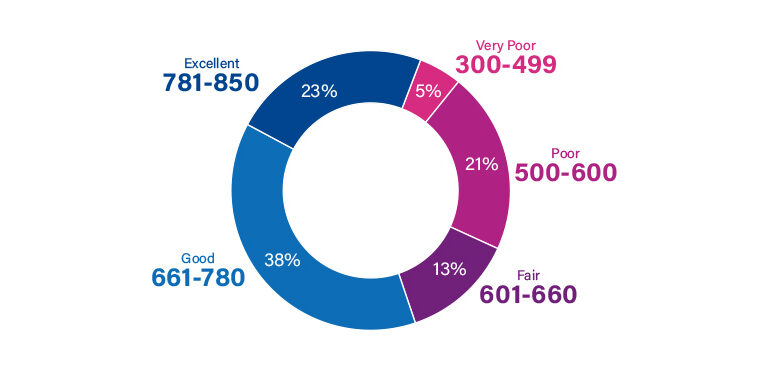

Required Credit Score: Good To Excellent

Annual Fee: $0

Purchase APR: 14.74% to 24.74%

Perhaps the biggest advantage of opting for this credit card is the luxury of combining no annual fee with $0 introductory APR. The two features make this card ideal of users who are facing debt and want to pay it off as soon as possible.

Foreign transaction fee of 3% does apply so you have to be careful if you are a frequent traveler and need the card with you for making payments abroad.

Are The Interest Charges High?

The first question that comes to mind when you hear about this credit card is “what happens after the introductory period is over?”

Most customers worry that they would not be able to deal with interest rates later on. However, as compared to other high-end credit cards, Citi Diamond Preferred comes with bearable APR that you can easily avoid by making timely payment and avoiding carrying balance from one month to the next.

Note! Citi bank charges 29.99% penalty APR on late payments.

Other than that, cash advances will cost your 25.24% APR. Since this rate depends on market prime rate, you have to keep it in check and ensure what the figure is at the time of your application approval.

Why Should You Choose citi.com/applydiamondpreferred?

Offers Longest Promotional Period

You will get to enjoy 0% APR charges on balance transfers for first 18 months.

\Although there are cards that waive off the fee in similar manner, no competitive card offers such a long promotional time.

However, you need to keep in mind that the actual fee for balance transfer will apply and only APR will be waived off.

Similar is the case with purchase APR.

The card offers 0% for 18 months after which each cardholder will have to pay the usual 14.74% to 24.74% (Variable) purchase APR. The exact amount depends on your credit worthiness and you will be notified for it as soon as your application is accepted.

Great Credit Card to Pay Off Debt

Your knight in shining armor if there is a dire need to pay off debt immediately.

How does that work? Let’s assume you have an account with outstanding balance.

While you are busy making payments every month, there will be interest accumulating that will make the debt difficult to pay.

What if you have Diamond Preferred account instead? No APR will be applicable for 18 months that gives you ample amount of time to get rid of the debt.

Amazing Customer Account Protection

Citi credit card offers 24 hours protection against fraud.

If the bank representatives notice that there was an unusual activity via your account, you will be notified immediately.

You will be covered with $0 fraud liability and customer support is available 24/7 for your assistance. If you misplace your credit card, you should get in contact with the bank within 24 hours in order to block your account or replace it.

Citi Entertainment Package

Becoming a Citi cardholder also lets you get tickets of thousands of event that are otherwise restricted. This includes presale tickets and access to anticipated concerts, sports events, restaurants, etc.

Convenient To Use

Citi credit card is all about comfort. You can choose the payment due date that suits you. For example, most customers align it with the date on which they get paid from work. This makes it easier to pay monthly charges on time.

Furthermore, the card supports contactless payment. You just need to tap it and be on your way.

Carries Foreign Exchange Fee

citi.com/applydiamondpreferred has a 3% foreign exchange fee. This means you would have to pay a considerable amount every time you use the credit card outside of the US. This limits the card usefulness especially for customers who are always on the go.

There Is No Reward Program

Although the card does have a number of other perks, there are no active spending rewards program. Customers are more inclined towards applying for cards that have cash back offers, travel points, bonus points, etc.

How To Respond To Mail Offer

Citi bank will send you a pre-approved mail offer if you qualify for the credit card. The letter comes with an invitation code and that is all you need to complete your application online!

Simply open their official website and enter the code along with your last name. Then click on “Proceed to Application”. The webpage will check that your code is authentic and then accept your application for further processing.

What To Do In Case Your Mail Offer Is Missing?

You can also apply for the credit card without any pre-approved mail offer just by visiting citi.com/applydiamondpreferred.

The page will ask you to provide your full name, SSN, date of birth, address information, contact number, email ID, and financial information.

Provide all the data and then click on “Apply Now”. After the submission is complete, you will be able to track the status of your application online. It might take the bank at least a week to form a final decision.

Is It Safe?

Citi Diamond Preferred credit card is quite reliable if you wish to avoid introductory APR for balance transfers and purchases. There is also no annual fee which makes the card easy to maintain in the long run.

Furthermore, Citi credit card offers 24 hours protection against fraud & legit. If the bank representatives notice that there was an unusual or scam activity via your account, you will be notified immediately.

You will be covered with $0 fraud liability and customer support is available 24/7 for your assistance. If you misplace your credit card, you should get in contact with the bank within 24 hours in order to block your account or replace it.

How To Get In Touch

Luckily, the customer support executives at Citi bank are highly trained to offer the best user experience. If you have any query that you wish to get a quick response to, feel free to call 1-877-625-6382.

Other than that, the application status of your card can be checked by calling 1-800-745-1534.

You can also send in a written mail to the following postal address.

“Citibank Customer Service P.O. Box 6500 Sioux Falls, SD 57117”

Other than that, all of their account on social media are active and provide instant response. This includes Facebook, Twitter, Instagram, and YouTube.

Wrap Up

Citi Diamond Preferred at citi.com/applydiamondpreferred has an easy and quick application process. This is further simplified with its pre-approved mail offer open for eligible customers.

0% introductory APR on purchases and balance transfers is the best stand-out feature for the card but there is a lot more than you can avail for once you become the cardholder.

We hope this article has highlighted all the essential information that you need to consider before you apply. Let us know about your experience with the card. Good Luck!

Frequently Asked Questions

Should I consider applying for Citi Diamond Preferred card?

This is an amazing credit card for people who wish to avoid balance transfer fee and introductory APR. The card offers 0% for first 1.5 years. Furthermore, it has $0 annual fee. You should definitely consider applying for this credit card if these were the perks you were looking for.

Can I apply for Diamond Preferred card with an average credit score?

You need a good to excellent credit score in order to apply for this credit card. Preferably your score should be higher than 700 to improve your odds of being accepted as a cardholder.

Is Citi Diamond Preferred card better than Citi Simplicity?

Although Citi Simplicity card comes with fewer fees, users have loved the other option due to its additional benefits such as Citi Entertainment and Concierge perks. Besides that, both cards offer $0 introductory APR and balance transfers as well as $0 annual fee.

Can I own two Citi credit cards at the same time?

Citi bank does not put a limit on the number of credit cards that it issues to the same user. You are allowed to have as many cards as you easily maintain. However, some sources have shared that you need to wait at least 8 days before applying for the second card if you have just applied for the first one.

Would Citi Bank improve my credit limit?

The bank does offer credit limit increases but you have to be a cardholder for at least 6 weeks before applying for credit line increase.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.