Cred.ai is a fantastic and distinctive high-tech card spending experience, unlike traditional banking platforms. It is a banking infrastructure with an exceptionally advanced, user-friendly mobile application.

- Cred.ai is a fantastic tool dedicated to simplifying transactions, managing spending, and offers multiple other budgeting tools as well.

- Some of its outstanding features include Stealth Card, Friend & Foe, Flux Capacitor, and Credit Optimizer.

- If Cred ai isn’t for you, it is possible to make use of alternatives services like SPARQ, Grow Credit, and Chargehound.

…and Much More!

Cred.ai – Everything You Need to Know

The mainstream target audience of Cred.ai is the Millennials and Gen Z population. It is presented as a group of oddballs, eccentrics, and outcasts born to bring something innovative apart from what already existed in the market niche.

Based on South Street in Philly, Credi.ai guarantees the customers that they won’t have to pay any fees or interest on the card.

- You won’t have to overspend as well, and you can build credit automatically.

Their mission is to surpass the old term banking system and introduce the new potential through the solid metal credit card it has for you in the box. You can use their Unicorn Card Credit wherever the Visa is accepted since they are head-to-toe licensed.

Credi.ai has worked from scratch, and the start-up built its underwriting infrastructure and optimized it for managing third-party cards. It is trying to get in the game by trying to work around the mindset of Millennials and Gen Z about credit.

Their metal card, free of cost, works two ways; you can simultaneously use it as a credit card and a debit card. In addition, it also offers the customers to get their paycheck before the original date.

Cred.ai – Cred Key Features

We will now step ahead to guide you further on what additional services Cred.ai company has for the customers. Some of the primary key features and services of Cred.ai include the following.

Stealth Card

Cred.ai offers virtual Stealth Cards primarily for sketch transactions, and you can use them over the phone, in person, or even through mobile digital wallets. It is known as the self-destructing cards, and as the company mentions itself, i.e., use it for your shady works.

Creating a shadow account becomes more accessible with this. You can delete it permanently as soon as you are done ordering something from a shady website. The stealth card gets instantly approved, and you can use it whenever you want to.

Friend & Foe

Friend & Foe feature of Credit.ai is where the transactions with vendors and merchants get approved, especially with those you love and trust. So even if things go south, you don’t have to worry about anything, even if your card does not work.

Real-time management is where the Friend & Foe feature can lend its expertise. You can easily manage your transactions with a single tap on the mobile application. In addition, you can stop unauthorized and fraudulent transactions from the merchants.

Flux Capacitor

A flux capacitor is the time machine of your money through which you can get your paychecks earlier than the designated date. It is called a time machine because it helps you look into the future and navigate your possible spending. It uses AI technology to look for any debts and clear them before they happen.

Smart budgeting with Flux capacitor is the key to planning your finances accordingly for the future as it gives early access to the spending power. Furthermore, it is free of cost, and you can go with it whenever you wish to.

Credit Optimizer

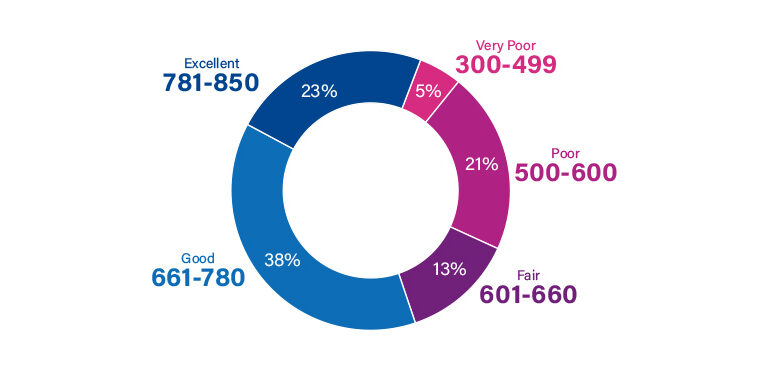

Credit Optimizer is one of the modern ways of managing and building your credit. There is also a money calculator by which you can segment your finances accordingly to prevent extra expenses in the future.

Credi.ai facilitates the customers with this feature and it does not charge any fees and interest. Furthermore, it helps you cover the costs of overspending beforehand, i.e., as soon as you join the mobile app, it immediately stops the transaction in case you start overspending.

Pros

- The card helps in building credit depending upon the usage.

- It charges no fees and interest, as mentioned earlier.

- The card can be utilized in around 55,000 ATMs that too free of cost.

- The credit card company offers top-notch quality and is metallic in nature.

- To provide additional security, the company offers stealth cards too.

- Once the application gets approved, you can use your virtual card.

Cons

- The company, unfortunately, does not offer any rewards on the purchases, unlike many other traditional banks who keep this as their vast selling point.

How to Apply for a Cred.ai Card – Step by Step Guide

The application process for the Cred.ai card is simplest and straightforward without any extra fatigue or hassle required. here is what you need to do.

- Go to the Cred.ai web version or the mobile application you have.

- Once started, you need to sign up first to proceed further.

- The portal provides relevant information in the fields, such as the mobile number and name.

- Then agree to the terms and conditions mentioned there by clicking on Agree.

- Once done, you will receive a verification code on the provided contact number.

- Then just enter the code, and you are good to go.

Extra Reading

Eligibility Criteria to Apply for a Credit.ai Card

Many banking platforms have particular criteria to be eligible for their services and financial products. The same goes with Credit.ai, and here is what you need to keep in mind:

- You must be at least 18 years of age and above.

- Also, it would be best if you were an official resident of the United States.

- Have an authorized and registered United States contact number.

As many banks require the customer to have a deposit account at their respective branch, Cred.ai needs nothing. As long as you check all the boxes of eligibility criteria, you can proceed with the application process.

Deposit Funds at Credit.ai

Several ways to deposit the money to Credit.ai are listed below. But, before this, make sure you have a registered account at Credit.ai. Otherwise, you won’t be able to make the transfers.

- ACH transfers: Allows transfers up to $250,000.

- Direct deposits: Transfer your commissions and salaries through direct deposits.

- Mobile deposits: Use the mobile remote image capture to deposit a check on the Credit.ai application.

Alternatives of Credit.ai

Credit.ai is in a saturated market of technology, and it has several contenders across the globe. Some of these are:

- SPARQ

It is a company known to develop a community-based personal finance platform.

- Grow Credit

It develops a platform that intends to expand the load to customers to expand their subscription services.

- Chargehound

Fights the disputes and chargebacks.

- Neufund

Blockchain-based and investor-directed platform to join the world of equity and cryptocurrency

Customer Support Service

Credit.ai has an agile customer support service, and in case you have any queries, you can always contact the customer support team on various platforms. The agile team is always willing to help you as the phones are answered by staff 24/7. Here is where you can get in touch with the customer’s representatives of Credit.ai.

The Bottom Line

Cred.ai is an impeccable service to which you can easily sign up by visit the official website. In addition to a range of features that it provides, you can make use of ACH transfers, direct deposits as well as mobile deposits.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.