It is quite difficult to find personal loans that are customer-friendly and affordable. Luckily, discoverpersonalloans com/apply is here to solve your problem!

The latest Discover Personal Loans reviews indicate that it is definitely a smart choice for borrowers who wish to consolidate debt, unforeseen expenses & home improvement.

Discover it loan does not charge any origination fee and it allows for direct payment to the lender to keep things simple and convenient for both parties.

What’s More? Through in this loan scheme, you can also check the estimated loan rate. This will not affect your credit score at all.

The only pre-requisite is that you need a good credit score in order to apply for Discover personal loan. Preferably, a good to excellent score would get you what you need.

- Are you going to give this one a try?

Continue reading to find out all about how www.discoverpersonalloans.com/apply invitation number through mail offer. We will take a look at its benefits, downsides, application process, application criteria and also give you a quick overview of how beneficial this scheme is as compared to other lenders. Stay tuned!

discoverpersonalloans.com/apply – In a Nutshell

Discover Personal Loan at a Glance

- Impeccable mobile app

- Loan on easy conditions

- Instant delivery of funds

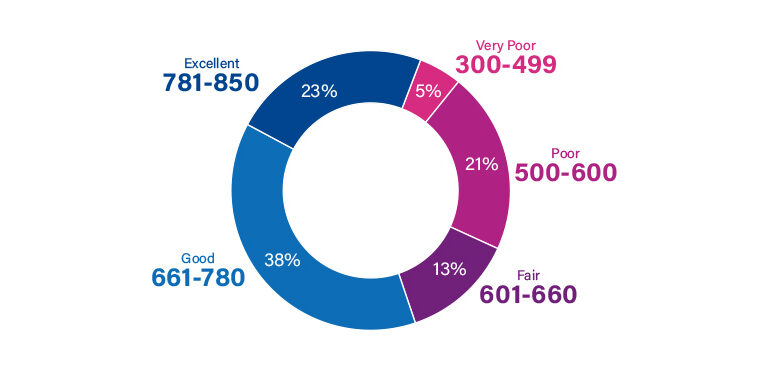

- Credit Score 660 – 850

Discover Personal Loans requires a minimum credit score of 660.

A quick comparison of different personal loans indicates that although Discover does not have competitive rates, it still offers an amazing customer support service, loan benefits, and commendable online experiences which makes it one of our favorites choices.

Let’s take a look at both sides of the picture.

What’s Good?

There Is No Origination or Application Fee

Many personal loan lenders charge hefty origination fee. Luckily, Discover loan is more user-friendly and ensures that you don’t encounter too many fees and charges. In fact, besides the late payment fee, Discoverpersonalloans does not require you to make any payment in addition to monthly bill.

Impeccable Customer Support Service

Discover Loan scheme is managed by US-based loan specialists. Their help is available at all days of the week.

You can call to get in touch with Discover representatives or access their loan financial education to lean more about associated terms and conditions. This portal is equipped with free articles and informative videos for your help.

30-Day Money-Back Guarantee

What if you realize that Discover Personal Loan is not suitable for your needs? In this case, you can make use of Discover’s 30-day, money-back guarantee. This means that you are allows to return the complete amount that you borrowed as a loan without paying any interest at all!

Free FICO Scorecard

Keeping a check on your FICO score is important if you wish to make improvements over time. Luckily, Discover lets it customers avail FREE FICO scorecard every month. You can check missed payments, keep a eye on credit utilization, known your total accounts, see recent inquiries, etc.

Let’s quickly sum up what we have talked about above:

- Discover Personal Loan does not carry any origination fee.

- You have to pay to lenders directly.

- It is backed up by impeccable mobile app.

- You can receive the loans instantly.

- You can choose from multiple repayment term options.

What’s Bad?

Late Penalty Fee

Paying off a loan is enough of a burden on its own.

On top of that, you would have to deal with late penalty fee of $39 with discover personal loans.com/apply.

This is applicable even if you miss a single payment. However, you can avoid this by paying on time and in full preferably every month.

No Co-signed, Secured, or Joint Loan Option

You need to qualify for the loan on your own. Discover does not provide the option of adding a co-signer or allowing for joint loan.

Furthermore, it is an unsecured loan which means you can not pay it off with collateral approach.

No Rate Discount For Autopay

Most of the mainstream lenders in the market now offer discounts on autopayments. This means you can avail 0.25% to 0.5% discount when you set up autopayments for your loan. Unfortunately, Discover does not offer any such concession to its customers.

Here’s a quick summary of what we just talked about:

- The loan charges late penalty fee.

- You can not avail co-signed loan.

- There is no secured or joint loan option.

- There is no rate discount for autopay.

Checklist – Here’s What You Need Before Application

Although Discover has not revealed the exact terms and conditions that are needed in order to apply for the loan, there are few pre-requisites that you have to keep in view. These include:

- You must be a legal citizen in the US.

- Every applicant should be above 18 years of age.

- You must have a minimum income of $25,000.

- Minimum credit score of 660 is required.

Other than that, the bank will look into your credit activities, credit history, previous credit inquiries, etc.

How Is The discoverpersonalloans As Compared To Other Lenders

So far we have discussed the criteria of applying for Discover Personal Loan. We have also talked about its benefits, drawback, and certain associated fees.

As an applicant, you must be thinking of exploring other options or at least checking out if there is any other lender that can provide loan on better terms. To save your time and energy, we have summed up the comparison for you below. Before that, take a look at the box below that will give you quick overview of Discover personal loans.

In a Nutshell: Discover Personal Loans requires a minimum credit score of 660. It has an estimated APR of 6.99% to 24.99%. The amount that you can qualify for varies between $2,500 to $35,000.

- Now where does this loan program stands as compared to other lenders? Let’s have a look!

Marcus by Goldman Sachs

This is another commendable loan scheme that many customers have tried and loved so far. Much like Discover, it also requires a minimum credit score of 660. However, Marcus Lenders impose lesser APR of 6.99% to 19.99%. You can opt for a loan amount of $3,500 to $40,000 that can be paid off in 3 to 6 years.

Payoff

Payoff loan program requires a credit score of at least 640 making it more affordable for those with a lower score. The estimated APR in this case is 5.99% to 24.99%. You can qualify for an amount between $5,000 to $40,000. This should be paid back in 2 to 5 years depending on the agreement you have with the lender.

A quick comparison of different personal loans indicates that although Discover does not have competitive rates, it still offers an amazing customer support service, loan benefits, and commendable online experiences which makes it one of our favorites choices.

Is Discover Personal Loan Right For You?

If the aim of your personal loan is to find an option that can help with debt consolidation then Discover Personal Loan is definitely the right choice for you. It can cater to both, credit cards debts and other types of debts.

Other Benefits!

Fortunately, Discover it loan is free of administration fee and origination charges. This is a huge benefit as it means you won’t have to spend extra money dealing with additional costs when you already have a loan to pay off.

Note! This loan requires you to pay directly to the lenders. This ensures that the money you got in name of debt would actually be used to pay down the loan.

Another advantage of opting for this personal loan is that you can receive the funds as quickly as the very next business day. If you have been approved, you can request for emergency transfer of the funds. In other cases, it can take as much as a week for the amount to reach you.

Till now we have been trying to answer your question of whether this loan is the right choice for you or not.

What if we have to explore the other side now? What if you realize that Discover Personal Loan is not suitable for your needs?

Here’s What You Can Do!

In this case, you can make use of Discover’s 30-day, money-back guarantee. This means that you are allows to return the complete amount that you borrowed as a loan without paying any interest at all!

Attention! Although this seems like a very simply approach, you would have to jump through many hoops before you can finally return the money. Therefore, it is better to look into terms and conditions before you apply for the loan.

Wrap Up!

A quick comparison of different personal loans indicates that although Discover does not have competitive rates, it still offers an amazing customer support service, loan benefits, and commendable online experiences which makes it one of our favorites choices.

- Keep in mind that discover personal loan is not the end of the world!

For example, customers with poor credit score have found Avant personal loan to be a better option since they could not qualify for Discover based on their credit. Similarly, LightStream loan is another reliable option if you are looking for lenders who offer larger loan amount.

Frequently Asked Questions

Would it be good for me to make use of Discover personal loan?

If you need an immediate loan and then wish to have a long period to pay it off, Discover it loan is a very good option. Payment time can be flexible from anywhere between 36 months to 84 months. The loan program also carries a very low APR ( just 6.99% ) so you can pay it off with a low cost.

What is I decide to pay my loan early?

That is completely up to you. There are no prepayment penalties with Discover Personal loan. You can pay it off early if you like or stick to the payment dates religiously to avoid interest charges.

Do you have to disclose your income information when applying for Discover loan?

Yes. The authorities will ask you to share some personal and financial information when applying for the loan. This also includes income, employment history, creditor information, account information, etc.

Discover Personal loan will hurt my credit score. Is this true?

Discover it loan comes with a soft credit pull. This is important to determine that rate and monthly payment that you qualify for but luckily, it will not affect your credit score.

What will happen if I am not able to pay off my personal loan?

The most dangerous part about not clearing your loan is that it will make your credit score drop drastically. Sometimes this can be as much as 100 points just after missing out on a single payment. On top of that, your chances to qualify for a good credit card or any loan in the future will be considerably reduced.

Do I need a good credit score for discoverpersonalloans.com/apply?

You require at least a credit score of 580 to 600 to qualify for personal loan. This is the minimum credit score requirement by most lenders. However, it can vary from one company to another. Therefore, always ask the lenders about terms and conditions before application.

Will my loan show up on my credit report?

Whenever you apply for a personal loan, the lenders will carry out an inquiry on your report. This can affect your credit score and also show up on your credit report.

What credit bureau does Discover personal loan rely on?

Discover it mostly uses Equifax however it does rely on all three major credit bureaus when it has to check your credit report and credit score.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.