When we have worked our way up to an acceptable credit score, we all wish to get hold of credit cards that offer more than just minimal perks.

That is what brings us to GetChaseSlate!

The Chase Slate credit card is definitely one of the best picks if you want to avoid annual fee, balance transfer free, and introductory APR. Sounds great?

We think so too! There are many reasons besides these why we would recommend customers with average to good credit score to try their luck with GetChaseSlate. Continue reading to find out about all the perks that you may get to enjoy.

Why You Should Choose GetChaseSlate?

Chase Slate credit card became popular as one of the best balance transfer cards. Since the card carries o% intro APR on balance transfers, customers in need could use it for over 15 months without paying any interest on balance.

But is it the only perk that makes this card stand out? Nope!

Chase Slate credit card also comes with purchase protection benefits.

The card provides complete security to its users and offers more control over how the consumers decide to utilize it.

On top of that, you can get access to Chase Slate Blueprint service.

This is an aggregation of different tools that can help you manage the credit card in the right way. Here’s what it is composed of:

- Full Pay: Decide the spending categories that you want to pay in full each month. This would help you avoid interest charges and make sure the bills are cleared on time.

- Split: Choose particular purchases and the amount of payment that you want to commit to certain category each month.

- Finish It: This impeccable tool helps you draw a solid idea about how long it will take for you to pay the balance in full. Finish It feature lets you keep an eye on interest payments as well.

- Track It: Maintain a check on your spending habits to understand which mistakes you are making to hurt your credit score.

As you can see, Chase Slate credit card is equipped with all the features that you need to fix the look of your credit score.

This is the reason why we regard it as one of the best options for improving score and avoiding some extra charges while doing so.

This was a quick overview of what the card holds for you. Now we will take a closer look at fees and terms associated with card’s use. Stay tuned!

Chase Slate Credit Card Review

- 0% intro APR

- Offers blueprint service

- Enhanced security

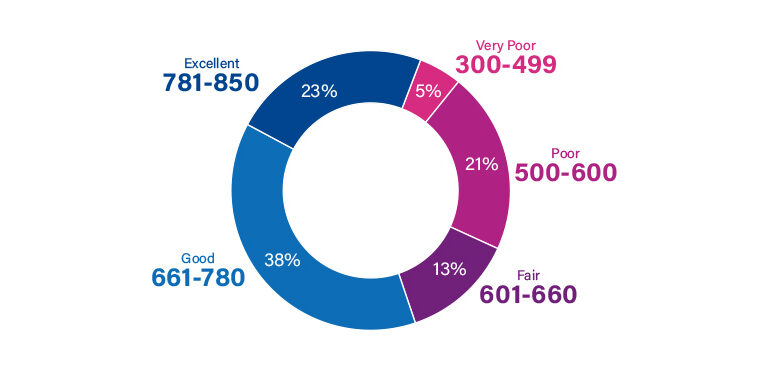

Required Score: Average to Excellent

Annual Fee: $0

Purchase APR: 16.49% to 25.24% Variable

As you can see, Slate credit card does not carry any annual fee so you would not have to worry about paying a hefty fee at the end of the month.

The next important point is that it has a variable APR of 16.49% to 25.24%.

However, for the first 15 months they don’t need to worry about any interest charges since the credit card has 0% intro APR.

The grace period for 15 month is a great feature that customers can utilize to slowly pay off their debt without incurring fees over time.

Now we come down to our favorite part: Having a Chase Slate account means you won’t have to pay any interest or any transfer fee in the first 2 months.

Are you wondering how this can help you? Let’s go over it!

Imagine you have a credit card with a balance that you are not able to pay off in full.

In this case, you will make minimum monthly payments along with interest charges that will keep adding up after each billing cycle.

This can amount up to a lot considering the applicable APR and length of period.

Not with Chase Slate credit card. This amazing option lets you save the extra charges by freeing you from balance transfer charges and interest charges for the first 60 days.

However, you need to keep in mind that the card does not offer any sign-up bonus neither are there any rewards program that you can utilize. On top of that, it is not a card friendly with foreign use as it charges 3% fee on all foreign transactions.

How To Respond To Mail Offer at GetChaseSlate.com

We have already established how Chase card can make life easier for you with $0 annual fee, no introductory APR on balance transfer and no introductory APR on purchases as well.

The next thing to talk about is how you can apply for this card. If you have received a pre-approved mail offer then the application process would be quite short and easy for you.

What is Pre-approved Mail Offer? Such offers mean that the bank has already run a check on you and it found you to be a worthy cardholder. Therefore, it is giving you a chance to apply for the card directly without providing all your personal information.

Although mail offers do not guarantee that your application would be approved, it does increase your chances and makes it easier for you to apply.

Chase also sends out pre-approved mail offers for its customers that can be a huge benefit if you are thinking of applying for Slate credit card. Let’s say you have got the offer in your mail box then here’s what you need to do next:

- Check that you have a stable internet connection on your laptop or smartphone.

- Click on the web browser to open it.

- In the search bar, type the address “Getchaseslate.com” and hit the Enter key.

- Locate the field asking you for the 12-digit invitation number. Type the code here that is printed on your mail offer.

- Under this field, you will find another box that requires you to enter the Zip Code.

- After you done providing both number, enter your last name in the relevant box. Then click on the Submit option.

Your application is complete!

What Now?

Once you have submitted the application, you should wait at least 7 to 10 working days to hear from the bank.

If your application is accepted, you will be notified via mail. Additionally, the credit card and other essentials would reach you within 2 weeks.

On the other hand, if your application is turned down, you will again be notified via mail along with an attached letter that explains why the bank could not accept you as a cardholder.

It is also possible that you don’t get to hear anything from the bank for 2 weeks.

This happens when the authorities think that there some pieces of information that need further scrutiny before they can draw a final conclusion.

In this case it is best to get in touch with their customer support service and inquire about the ongoing situation.

Steps To Take In Case Your Mail Offer Is Missing

Getting a pre-approved mail offer really shortens the time it takes to apply for the Chase credit card. However, it is not the end of the world if you did not receive the offer!

There are multiple routes you can take in order to continue with card application if you had not received the mail offer.

First of all, on the same official page, you would find a button stating “Look up your invitation number”. This would ensure if you are eligible for the pre-qualified offer.

Other than that, You can also apply for an offer that does not need a confirmation number. This is a normal application procedure that would require you to enter your full name, social security number, address, phone numbers, etc.

Is It Safe For You?

Now we get down to the legitimacy of Chase Slate credit card. Many customers worry about how safe this card is before applying for it.

Luckily, this is a very safe option for all users who wish to boost their credit score fast while avoiding extra charges and expenses. The bank is also completely reliable when it comes to safeguarding your personal information from unauthorized third-parties.

If you have received the invitation number, then you can complete the application process in just a couple of minutes. The representatives at the bank are also quite helpful. You can always reach out to them in case you have any queries.

How To Get In Touch

The Chase Slate customer service is available at 800-432-3117. Unfortunately, we do not know of any other method to get in touch with their support team. You can, however, leave important queries on their official website as well.

Final Words

Chase Slate is one of the best credit cards that you can apply for with average credit score. Most other credit cards within this category do not spare the users from annual fee or balance transfer fee at all.

That being said, you have to note that applicants with at least good credit score do have other options on the shelf. In fact, they can apply for other cards that either have longer grace periods or come with better reward programs.

How about you take some time to decide and let us know what your final choice is? Also, if you think we have missed out on something important, let us know! Leave remarks or queries in the comment section below. We will get back to you in blink of an eye.

Good Luck!

Frequently Asked Questions

Is Chase Slate credit card better than Chase Freedom?

When you are comparing these two credit cards you would realize that both of them are amazing options but they are meant for different type of cardholders. Freedom credit card is a good option for those who want to avail cashbacks.

On the other hand, Chase Slate card saves users from a number of additional fee. Therefore it is better for those who want to get over credit card debt.

Is there a maximum credit limit that I can avail with Chase Slate card?

Unfortunately, the bank has not revealed any amount when it comes to maximum credit limit. However, it is clear that each approved cardholder gets a minimum credit line of $500. It can be more depending on your creditworthiness.

Is it possible to upgrade your Slate card to Chase Freedom?

Yes! You can simply call the customer support service and request them for the upgrade. Many customers choose Chase Slate card when they wish to overcome credit card debt. Once you are done, you can upgrade to Freedom card and enjoy bonus miles and 5X points on different category purchases.

Is it easy to get approved for Chase Slate card?

You need at least credit score of 550 or more to get approved for this credit card. It offers easy approval for all applicants who have better-than-average credit score.

How can I apply for credit limit increase with Chase Slate?

If you want to request a credit line increase, you would have to call the authorities directly. With Chase Slate card, the limit can only be increased over phone. There is no online portal that you can use for this task.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.