If you are currently struggling with a poor score, you should consider looking into PlatinumOffer first premier credit card immediately. First Premier Bank is now providing its Platinum credit card via pre-approved mail offer. You just need to get your hands on the confirmation number to proceed with the online application.

- Platinumoffer is meant for people with poor credit score as it offers easy approval odds and features to rebuild credit score.

- The annual fee is up to $75 and it charges regular APR of 36.

- You need to visit First Premier Bank official website and provide the confirmation number to complete credit card application online.

…and Much More!

Why Should You Choose PlatinumOffer.Com?

There are a number of features that make it a safe choice especially for those who wish to improve their credit score. In fact, PlatinumOffer was primarily put forward for people who are struggling with credit score and wish to use an easy-approval card to change their game.

Platinum credit card regularly reports to major credit bureaus. Platinum Mastercard also revises your performance after 6 months to determine if you are eligible for a credit line increase.

Lastly, you will be eligible for $0 fraud liability in case the card gets stolen. This means that you will not be held accountable for any unauthorized purchases made in this period.

First Premier Bank Platinum Card Review

First Premier Bank Card at a Glance

- Okay with previous bankruptcy

- Quick Credit Line Increase

- Reports To Major Credit Bureaus

- Credit Score 350 – 850

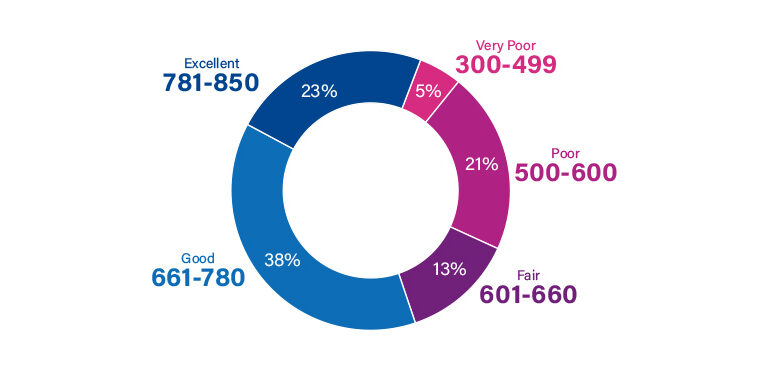

Recommended Credit Score: Poor to Average

Annual Fee: $0 – $75

Purchase APR: 36%

Platinum credit card is meant for customers with an average credit score. However, there are a number of associated fees that you need to watch out for. First of all, the annual charges can vary between $0 to $75 depending on your credit worthiness.

Additionally, Platinum credit card does carry a variable APR of 36%. Unfortunately, this can be troublesome if you are habitual of making payments after due date has already passed.

You might be wondering why you should even consider this hefty credit card. However, you need to keep in mind that such fees are common for credit cards that are open for those with poor credit.

They are charged as means of security by the bank to ensure the cardholder continues using the card with a responsible behavior. Now that we are discussing fees and expenses, let’s take a thorough look at what you would have to deal with:

- First of all, the actual annual fee and credit limit would depend on your creditworthiness.

- Keep in mind that processing fee is $95 regardless of the limit that you are approved for. It is only reduced to $75 for customers who are eligible for the highest credit line i.e. $600.

You might be interested in reading: Indigoapply.com.

Platinumoffer.com First Premier Bank Credit Card – Fees

- For credit limit of $300, you would have to pay $75 annual fee for first year and then $45.

- Then for credit limit of $400, you would have to pay $100 annual fee for first year and then $45.

- For credit limit of $500, you would have to pay $125 annual fee for first year and then $49.

- Then for credit limit of $600, you would have to pay $79 annual fee for first year and then $49.

Note! The monthly charges are typically waived off for the first year. After that, you will be charged with $6.25 per month to $10.40 per month depending on your credit line.

Luckily, Platinum credit card offered by First Premier does allow for withdrawing cash in advance but you need to pay 5% fee in order to do so.

Respond to Mail Offer at Platinumoffer.com – Step By Step Guide

One of the best ways to apply for this card is to do so via pre-approved mail offer. This is an offer that is sent out to eligible customers that the bank thinks should own their credit cards.

- If you have received a mail offer from First Premier Bank then you simply need to visit their website.

- Once you are at their official page, you would have to provide the confirmation number. This will be included in the mail offer that you had received previously.

- Simply type in the exact number and then click on “Submit”.

Once you are done with the application, following outcomes are possible.

- If your application is accepted, you will get a response within 7 to 10 days. Shortly thereafter, the card and other essentials would be mailed to you.

- In case your application is rejected, you will get an email informing you of the decision along with the reason behind denial.

- The last possible outcome is that the response will be delayed for up to 2 weeks. This happens when your application needs more processing or the bank has to check certain data related to your credit report.

Steps To Take If Your Mail Offer Is Missing

There is no need to panic if you have not received any credit card mail offer. You can still option to fill application and have the bank process your request immediately.

All you have to do is visit the same official page www.platinumoffer.com and locate a link that states, “See If You Are Pre-qualified”. Clicking on it would open a digital form where you need to enter

- Full name

- Contact information

- Email ID

- Social security number

After providing this information, click on Submit and you will immediately receive a reply explaining whether you are eligible for the ongoing offer or not.

Is First Premier Bank PlatinumOffer Legit?

First Premier Bank has been around in the US for many years now. Consequently, it has provided credit cards to a number of users and so far there have been no reports of any fraudulent activities.

First Premier Bank is a legit platform offered and maintained by First Premier Bank. It is open to all its customers so you don’t need to worry if the website is legit or fake.

Customers who are currently working with credit cards available at this portal are more than happy to report that these helped them improve credit score quicker than they thought.

- The same can be said about Platinum credit card as it is completely reliable and makes sure you get to enjoy all the features that would help you fix credit score.

Furthermore, the bank provides amazing customer support service. Their representatives are always in reach and ready to answer any questions or doubts that you may have.

First Premier Bank Customer Support Service

It is very easy to reach out to one of their representatives. In fact, you can simple call on the toll-free number 1-800-987-5521.

You can also send in a hand-written mail to the authorities but this is not quite helpful if you wish to get an instant response.

The Bottom Line

First Premier hosts a wide variety of credit cards and the best part is that you can complete almost all applications online without any hassle. However, not all cards here are meant for poor credit score so you would have to do some research beforehand.

Nonetheless, Platinum credit card is one such option that can fix your credit score in no time. Furthermore, it is a completely reliable credit card that reports to all major credit bureaus and helps you maintain a good credit history.

Frequently Asked Questions

Does First Premier Bank increase credit limits?

Yes. You can be eligible for a credit limit increase after maintaining good spending habits for at least 6 months. However, there is an associated fee of about 25% of the limit that is being increased.

Is PlatinumOffer legit?

First Premier Bank has been around in the US for many years now. Consequently, it has provided credit cards to a number of users and so far there have been no reports of any fraudulent activities.

Can I cancel my First Premier Bank Platinum credit card?

Yes! You reserve the right to cancel the card or close the account as per your need. In fact, if you do it within 30 days of being accepted as a cardholder, some of the charges such as program fee, will be refunded immediately.

What credit score do I need to be eligible for Platinum Credit Card?

Platinum credit card is open to those with a poor credit score or even a previous bankruptcy so you don’t need to worry much about the shape of your credit report.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.