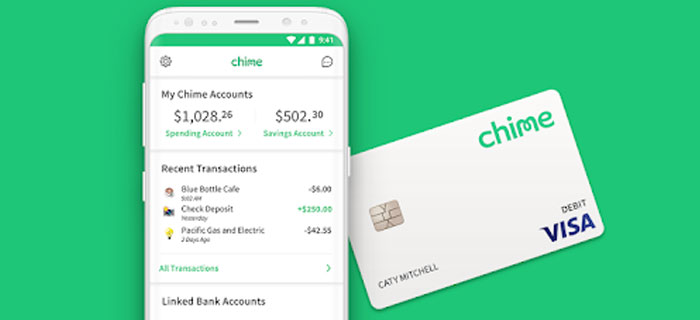

Chime, as an online bank, is extensively used to transfer funds with other accounts. However, if you run out of balance, here you will know to send money via your chime account. Let’s find out!

Connect your TransferWise for easy transfer of payments

1. Friends can send you money from their Chime Account by Select Transfers > Pay Friends > Amount of Money > Send.

2.Other bank accounts can be used to deposit funds in Chime by Money Transfer > Account + Routing Number > Amount of Money > Send.

3. Chime accepts transfers from Cash App, PayPal, Western Union, Payoneer, MoneyGram, Venmo, and Zelle.

…and Much More!

Can Someone Send Me Money To My Chime Account For Another? – Tips

Chime is the best platform that accepts payments and transfers from countless other accounts and mobile money transfer apps.

Other Chime users can send you money on your Chime account as well.

- They should first open their Chime account and then tap the Money Money option.

- Click on Select the Transfers.

- Hit the Pay Friends option. Now, provide the account details of the recipient, such as name, account number, and email ID.

- Please enter the amount of money that they wish to transfer.

- Recheck the information and click on Send.

The money should be reflected in your Chime account shortly. Other than that, it is possible to accept funds on account via PayPal, Western Union, Cash App, and many more, which we will discuss below.

Chime Pay Anyone For The Transfer

The Chime Pay Anyone feature makes it possible to send or receive money from others without depending on a Chime account.

Pay Anyone simplifies money transfers. You only need to share your $ChimeSign, email address, or phone number with the sender. The other party can then send money instantly. Chime Pay Anyone normally takes little time to process transactions.

How To Transfer of Money From Another Bank to Chime

Senders don’t need to own or sign up for a Chime account to send money to other Chime accounts. It is possible to use the account number and routing number of a bank account for ACH money transfer.

- Visit the bank physically or use online banking or a mobile app to open their Money Transfer section.

- Share the account number and routing number of the Chime bank account.

- Enter the amount of money that you want to send.

- Initiate the transaction. It may take up to 3 days – 5 days to complete.

This applies to almost all the leading banks in the US, including Bank of America, Citi, US Bank, and Capital One.

Once you link an external bank to your Chime account and make a transfer, it can typically take 2-3 business days to process.

Send Money To Chime Account Through Direct Deposit

You can request an employer or any other payer to set up direct deposits to your Chime account. In this way, you can get the paycheck and benefits sent directly to the Chime checking account.

Direct deposits with Chime are the fastest way to receive money. Moreover, it is free!

Transfer of Money From Cash App to Chime

Cash App supports money transfers to a number of apps and accounts, including Chime as well. Similar to Chime, it is an online platform extensively being used to send and receive funds.

Once you have linked your Cash App account to Chime, there should be no issues in sending money from Cash App Chime and, alternatively, receiving money on the Cash App account through Chime.

- Open the Cash App account and click on the Balance Tab.

- Choose the Cash Out option, then provide the amount of money you wish to transfer.

- Choose whether it should be a standard or instant transfer.

- Confirm the transaction by entering the PIN.

The instant transfer should be complete within 30 minutes. On the other hand, standard transfer can take up to 3 business days. Contact the Cash App customer care center if there are any further delays.

You may also be interested in: How to get money off Cash App without card.

Transfer of Money From PayPal to Chime

PayPal is a globally-trusted platform for peer-to-peer money transfers and online payments. You can use it to send money to Chime or receive money on your PayPal account from Chime.

However, a tad bit of the problem here is that it is not possible to link Chime and PayPal together for direct transfers. Consequently, you have to use an intermediate account.

- Open a PayPal account and choose to Transfer Funds.

- Provide the routing and account number of your bank account.

- Receive funds in the bank account.

- Link bank account to Chime.

- Open Chime and enter the same amount of money to be transferred from the bank to the online Chime account.

You may also be interesting in: How to transfer money from PayPal to Cash App.

Transfer of Money From Western Union to Chime

Western Union has been a reliable international money transfer platform since its launch in 1851. Moreover, you can use it to transfer funds to a Chime account locally as well by adding it as a linked bank on Western Union.

- Access Western Union through the mobile app or online account.

- Tap on the Send To option and then click Send Amount.

- Select the Bank Account of your choice. In this case, you have to provide the details of your Chime account.

- Initiate the transaction.

- Make sure to retain the tracking number, as it would help you identify when the funds reach the other account.

Transfer of Money From Payoneer to Chime

Payoneer to Chime money transfer is also possible as it allows the two accounts to be linked for transactions.

- Open a Payoneer account.

- Provide the routing number and account number of the Chime bank account.

- Enter the amount of money that you wish to send.

- Confirm the transaction. Wait for up to 2 days- 5 business days for transfer to finish.

Transfer of Money From MoneyGram to Chime

=If you have a MoneyGram account, you can easily send funds to Chime.

- Open MoneyGram on your mobile or laptop screen.

- Click on Send Someone New or tap Existing Receiver as needed.

- Specify the account to which you would be sending the money.

- Tap on Account Deposit and then choose how you wish to pay.

- Hit the Send Money button. You may need to wait up to 5 days for a transfer to finish.

Transfer of Money From Venmo to Chime

Similar to the transfer of money from Cash App to Chime, Venmo can also be linked to your Chime account to send and receive funds smoothly.

- Open Venmo and add Chime as a linked bank on your App.

- In the Venmo app, tap on Manage Balance.

- Select Send Money and specify the amount that you want to transfer.

- Choose Chime as the bank account in the next step.

- Click on Proceed.

Transfer of Money From Zelle to Chime

Zelle is not listed on the approved partner list for Chime, so can someone send money to my Chime account from Zelle? Many users are under the impression that it is not possible to transfer money from Zelle to Chime.

- You can use the Zelle Payments app to add money to the Chime debit card and, consequently, the Chime bank account.

However, such payments are processed differently. Instead, they are transferred using the ACH network, so it can take a longer time for the money to be deposited in your Chime account.

Extra Reading

Perks of Having a Chime Account

There is no doubt that Chime is a convenient online banking solution that allows you to transfer funds immediately with the help of a checking account.

In addition to this, it carried a number of other benefits as well.

- Complete Online System With No Delays

Chime completely operates online with an impeccable digital system. It is fit to replace traditional physical banking with easy management via smartphone or computer.

- Minimal Fees and No Hidden Charges

There are no monthly, overdraft, or foreign transaction fees with Chime money transfers.

- No Requirement For Keeping Minimum Balance In Your Account

Not only is Chime free of transaction charges and monthly fees, but it also does not require you to have a minimum balance in the account at all times.

- Safe-To-Use Chime Debit Card

You can apply for a debit card via an app or online bank and use it to make transactions. Moreover, it safeguards you against illegal use of the card with $0 liability.

- Money Is FDIC-Insured

Chime ensures your funds are up to $250,000. This means even if the institute clashes, you can get reimbursement for the lost money.

What is Chime Account Withdrawal Limits

There are limits on how much you can take out from your Chime account via ATM, PIN transactions, or with over-the-counter withdrawals.

- These limits have been put in place to restrict users against overspending and minimize damage to savings if the account falls into the wrong hands.

You can withdraw a maximum of $500 per day from your Chime account via ATM. Over-the-counter withdrawal also carries the same limit. In total, PIN transactions have a limit of $2,500 per day.

Can You Delete Chime Account Permanently

You can request the team at [email protected] to help you delete your Chime account permanently if you don’t need it anymore.

However, before you proceed with this, make sure you have taken out any cash that you still have in the account, and also check that there are no pending transfers in your Chime.

We have discussed the process of how and why to delete Chime in more detail in our previous article. Click here if you are interested in reading in depth.

The Bottom Line

A Chime account is a reliable way to send and receive money from other accountholders and through different money transfer apps. You can easily accept funds from your friends or family via Cash App, PayPal, Zelle, Payoneer, Western Union, and other bank accounts.

- It is also possible to receive funds on Chime through Skrill, TransferWise, Google Pay, and Stripe.

Chime is an online banking system, so we recommend readers take care of their login credentials at all times. It is an excellent service as long as you use it responsibly!

Frequently Asked Questions

Can my friend directly deposit money into my Chime account?

Yes! Anyone can send money to your Chime account by using a bank account or different money transfer apps. All they need to provide is your Chime username along with your phone number or email ID.

Similarly, you can also send money to another account through Chime. The time it takes for the transfer to complete is variable, depending on the platform in use.

Can someone send me money to my Chime account if they don’t have a Chime account?

It is optional to have a Chime account when you wish to send funds to a user with a Chime account. You can use other payment apps to transfer the funds.

How can I deposit cash in my Chime account?

You can send money to your Chime Spending Account using any of the 90,000 retail locations present around the US. This includes cashiers in Walmart, Walgreens, etc., who can take cash from you and deposit it in your Chime account immediately.

Does it cost extra when I send money to my Chime card?

Transfer of money to a Chime card at a retail location does incur extra charges. Some stores may charge anywhere between $3 to $10. However, there is only an approximate value. It depends on the amount that you wish to transfer.

The general rule of thumb is that the larger the transaction, the more would be the money transfer fee.

Is Chime online banking safe to use?

Chime is an online bank that allows applicants to open checking accounts savings accounts, or get hold of a Chime card. All the funds, once deposited in the Chime account, are FDIC-insured, so you can consider it a safe spot for your money.

How do I send money to Chime from a debit card?

You can link the external bank account and add the debit card number to transfer funds from the debit card to the Chime Checking Account.

Jamie Johnson is very enthusiastic Kansas City – based freelance writer, and her core expertise are finance and insurance. She has been endorsed on several personal finance, insurance & business website to share her thoughts. Her publications can be found on famous sites like Bankrate, The Balance, Business Insider, Chamber of Commerce and many others.

From many years, she served more than 10,000 hours of research and writing to more than 2000 articles related to personal finance, credit building, mortgages, and personal and student loans.