Although the majority of us have shifted to credit card use for daily purchases such as getting fuel via credit card or shopping online as well as monthly bills, there are instances when you might need cash, for example, to pay for a parking ticket or buy your kid an ice cream at a fun fair. If plastic is all you have in the wallet, then you might be wondering how to get cash from a credit card.

- The most reliable method to get cash from a credit card is either to opt for a cash advance or earn cash back rewards.

- Cash advances can be expensive as they charge high interest rates and may affect your credit score adversely.

- Other ways to get cash besides cash advances is to save money by paying bills through the card or requesting a friend for cash in exchange to money transfer.

…and Much More!

How To Get Cash From a Credit Card?

Regardless of why you need the cash, there are majorly only two direct ways of getting it through credit card. Either you can opt for a cash advance which typically costs high interest rate and is considered an expensive method. On the other hand, you can use the credit card to earn cash back rewards. Let’s look into both these options in more detail!

Get Cash Advance From a Credit Card

Cash advances are pretty simple. You can just use your credit card as a debit cart at supportive ATMs to take out cash. However, that will ofcourse leave you with lower credit limit and a balance that you have to pay off at the end of the month. Moreover, cash advances come with a fee which in many cases, is quite high.

You might be interested in reading: Apps Like Dave To Get Cash Advance.

Not all banks or credit card issuers offer cash advances so you have to confirm via user agreement that you can withdraw money from credit card at an ATM. If all is good, here’s how to take cash out of credit card at an ATM.

- Visit a nearby ATM and insert your credit card in the right slot. Afterwards, provide PIN for the card to continue.

- Tap on Cash Withdrawal or Cash Advance. These labels often differ from one credit card to another.

- Then click on Credit and choose Credit Card as the option from where to wish to withdraw cash.

- Provide the amount of money you want to take out and agree to paying any associated fee as mentioned on the ATM screen.

- Wait for withdrawal and take out your card from the ATM slot.

Also, note that there are ATMs that let you overdraft either your bank account or credit card but this feature is not available everywhere.

Chase Freedom Unlimited

Credit Score Requirement: Good to Excellent

Annual Fee: $0

Annual Percentage Rate: 14.99% to 23.74$ Variable

This is another option that charges no annual fee and also has 0% introductory APR on eligible purchases for the first 15 months. Users can earn 1.5% cash back on everything that they purchase through this card on up to $20,000 spent in first 12 months. There is no minimum limit on when you can redeem the rewards which is another outstanding benefit.

You can also get access to cash advance with Chase Freedom Unlimited. The fee is considerably high though but the card seems quite attractive considering the reward potentials.

- The card offers 6.5% cash back on travel related purchases and 4.5% cash back on purchases made at a drug store.

- 3% cash back is applicable on all other purchases for the first year.

- You can get the cash deposited directly into any of the US checking account or savings account.

- There is a 0% introductory APR for the first 15 months of account opening.

- You can redeem the rewards whenever you want.

Capital One Venture Rewards Credit Card

Credit Score Requirement: Excellent to Good

Annual Fee: $95

Annual Percentage Rate: 15.99% to 23.99 Variable

The card stands out with its offer of 60,000 one-time miles bonus on spending $3,000 on purchases within 90 days of becoming a cardholder. This is roughly equivalent to $600. Capital One Cardholders can also earn up to 5X miles on booking hotels or rental cars through this credit card.

The best part is that the card has relatively low cash advance fee and comes with a reasonable APR. It is also packed with benefits relevant to everyday travelling which can help you save a lot. However, you won’t be able to earn any rewards on cash advances.

- You can earn unlimited 2X miles on every eligible purchase that you make with Capital One Venture Rewards Credit Card.

- Miles can be used to get reimbursement for any travel purchases.

- The reimbursement also works for booking a trip through Capital One card.

- These miles do not expire as long as your account remains active.

- There is no limit on the miles that you earn via Venture Rewards credit card.

Capital One Platinum Credit Card

Credit Score Requirement: Average to Good

Annual Fee: $0

Annual Percentage Rate: 26.99% Variable

Perhaps the best thing about this credit card is its no-annual fee policy. Moreover, Capital One Platinum Credit Card automatically increases the credit line available to users after 6 months much like how Doubleyourline cards work. However, you need to exhibit responsible use. Moreover, frauds are also properly covered by the authorities.

You can get relatively low cash advance with Platinum credit card but it is available to those with poor to average credit scores which makes it easier to quality for as compared to Venture Rewards credit card. The APR is considerable but same as the regular APR i.e. 26.99%.

- The online banking is swift and backed up by an impeccable mobile app as well.

- You can pick the due date for paying off the cash advance as per your needs.

- It offers contactless payments as well.

- The qualification criteria is fairly easy.

- This credit card can help you build your credit score over time.

Things To Consider When Opting For a Cash Advance

There is no exception to this rule: You must pay off the credit card balance at the end of money if you wish to avoid any unpleasant charges. Similarly, cash advances have to be dealt with serious as they are quite a common reason why cardholders fall into debt scenarios.

- Interest Rates Are High For Cash Advances

Credit card interest rates are reasonable for regular purchases but when it comes to cash advances, you might be dealing with a scary figure. Moreover, as is the case with grace period or the no-introductory interests, most credit card issuers do not offer any such perk with cash advances. If you are not able to pay off the money quickly, the debt may pile up.

- It May Affect Your Credit Score Adversely

Cash advances take out amount from what is available in your credit card and thus, lower the available balance. If not repaid quickly, it will decrease your credit score and make it difficult to apply or a new credit card or a loan in the future.

- There is a Cash Advance Fee

ATM withdrawals through credit card typically cost 3% to 5% one-time fee. This charge is variable depending on the credit card that you use. It is better to go through the terms and conditions of the particular card on the official website before opting for the cash advance.

You might be interested in reading: Does Ross Have a Credit Card?

Get Rewards in Form of Cash Backs Through Credit Card

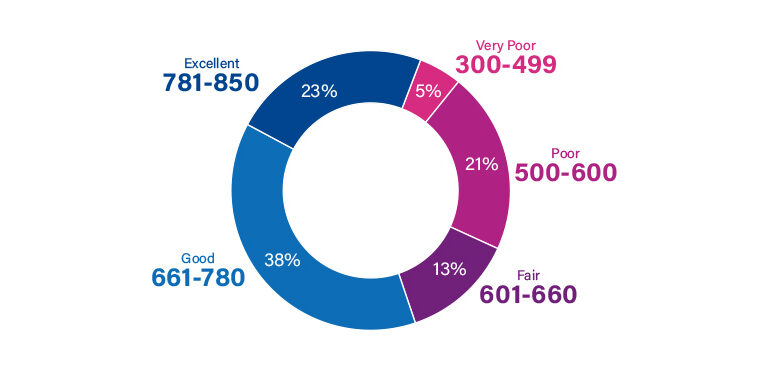

Another popular way of obtaining cash through credit card is to earn it in form of cash back rewards that most outstanding credit cards have to offer. As you know, credit cards are available for all types of credit profiles and depending on your score, you can apply for a card that promises sufficient rewards.

It also fruitful to look into spending categories that will earn you cash back. Customers tend to choose the ones that regularly shop in to maximize their earning. You can opt to get the deposit directly into an eligible bank account or redeem it in form of a physical check, as per your need. Typically, there are two types of cash back reward cards:

- Unlimited Cash Back At Single Rate: 1.5% to 2% cash back on every purchase.

- Lower Unlimited Rate on Most Purchases: 1% flat cash back on all purchases and some times offering higher cash back rates on specific purchases.

However, when it comes to getting money through this means, it largely depends on how responsible you use the credit card. After all, the cash backs that you earn here will not be able to outpace the interest charges at the end of the month if you are overspending and not paying of the remaining balance timely.

You might be interested in reading: Aspirecreditcard.com for Aspire Cash Back Rewards.

Chase Freedom Unlimited

Credit Score Requirement: Good to Excellent

Annual Fee: $0

Annual Percentage Rate: 14.99% to 23.74% Variable

The best part about this credit card is that it not only comes with handsome cash back schemes but does not charge any annual fee either. Moreover, there is no minimum cash back threshold to redeem your rewards so you can get what you have earned any time that you want!

Users can get the rewards deposited directly into their US checking accounts or savings accounts. There is no expiry date for the cash back rewards and the card has 0% introductory APR for the first 15 months of becoming a card holder.

- You can earn 1.5% cash back on everything you buy through this credit card.

- It offers 6.5% cash back on travel related purchases and bookings and 4.5% cash back on drug store purchases.

- The rewards will not expire as long as your account remains active.

- There is no annual fee which is a huge perk considering all the rewards that come with the credit card.

- There is no minimum threshold for redeeming cash back.

Discover It Cash Back

Credit Score Requirement: Good to Excellent

Annual Fee: $0

Annual Percentage Rate: 11.99% to 22.99% Variable

When it comes to cash back rewards, credit cards just do not get better than Discover it Cash Back! It offers up to 5% cash back on everyday eligible purchases with quarterly rotating categories. On top of that, users will automatically get 1% cash back on all the other purchases made via Discover It credit card.

In fact, this card is famous due to the rotating cash back bonus categories which not many other options offer. However, you must activate the bonus category quarterly as well as adhere to the spending cap. The robust customer support service is available to guide you further on this.

- It automatically matches all the cash back earned at the end of the first year.

- The cash back reward schemes here are more fruitful as compared to other options in the market.

- You can redeem the reward at any point and any time.

- The cash back earned here does not have an expiry date as long as your account remains active.

- There is no annual fee!

Discover It Secured Credit Card

Credit Score Requirement: Poor to Average and even new people with no credit history

Annual Fee: $0

Annual Percentage Rate: 22.99% Variable

This one is a pretty good choice for people with poor credit score or no credit history who still want to earn cash back rewards. The qualification criteria is easy and it allows anyone to open an account. However, since it is a secured credit card, you must make a minimum deposit. You may be able to upgrade to an unsecured account after a set period of time but it depends on how well you use the credit card to build credit history.

- It is one of the top choices for people who wish to build their credit history with the bureaus over time.

- The minimum deposit required may be up to $200.

- You can upgrade to unsecured account after 7 months of responsible use.

- It offers 2% cash back at gas stations and restaurants as well as 1% cash back on all other eligible purchases.

- The card is accepted nationwide.

Other Ways To Get Cash From a Credit Card

If credit card to cash via cash advances seem to expensive and getting cash back rewards sounds like a long shot, you are still not out of luck for getting cash through credit card. Some other simpler methods to obtain the money have been discussed below. Take a look!

Buy a Prepaid Gift Card

An interesting way to get cash from a credit card is to use it to buy a prepaid card or a gift card and sell it for cash. You can choose to sell it to a friend or relative in need or visit one of the online marketplaces that assist you with such activities.

You might be interested in reading: Transfer Money From Credit Card to Prepaid Card.

Pay Bills Using Credit Card and Save Cash

Instead of using the cash the in your wallet, you can pay for purchases via credit card and free up the paper money for other uses. However, this might not be suitable in all scenarios.

For example, certain merchants and billers charge a fee when you make a transaction through credit card. In this case, paying with cash would be more reasonable. On the other hand, there are credit cards that come with no-introductory APR which means you can buy something and not worry about incurring interest. These are great cards to use for purchases and bills.

Request Friend For Cash and Send Money To His Account Via Credit Card

Credit cards are a good source to pay for large purchases. Therefore, if you have a friend who wants to buy something, you can offer to pay via credit card and exchange cash. In fact, mobile payment apps such as Cash App has made it quite easy to send and receive funds from friends and relatives.

The Bottom Line

Cash advance is the most common way that majority of the cardholders use to take out money from their credit cards. However, it must be considered as a last resort because the interest that it incurs means it is relatively an expensive methods as compared to other options.

- Getting a cash back, paying bills using credit card, or exchanging funds with a friend for money will not cost you interest in any way.

There is one thing that you should always keep in mind! Although you can choose to get cash from a credit card in different ways, any method that you employ would still mean that you are borrowing money and need to pay it off at the end of the month. Consequently, failure to do so will pull down your credit score and make it difficult to apply for a new credit card next time.

Frequently Asked Questions

How can I withdraw money from a credit card?

Withdrawal of money from credit card works in the same as a debit card. You have to insert the card and provide PIN. Then enter the amount that you want to take out. For the transaction to finish and take out your card from the ATM slot.

How can I get cash from my credit card without a PIN?

It is not possible to take out money from credit card at an ATM without the PIN. Alternatively, you can visit the bank or the credit card issuer, provide the card and request for the cash advance. In this case, you might have to present government-issued photo ID for verification.

How do I get the PIN for credit card?

In order to obtain the PIN, you will have to visit an ATM and insert your credit card. Then click on Create PIN using OTP. You can then select the PIN for your card after you provide the OTP delivered to you via registered mobile number.

Can you withdraw cash from a credit card online?

You may not be able to withdraw money online from a credit card. What you can do is transfer the amount to your bank account and take out money via banking app.

Cassidy Horton is freelance finance base research writer and published hundred of articles on money, banking, loan and more. Her work is published authority finance site on Forbes, Money Under30, NerdWallet and many other finance brands. Further she is considered financial expert by MSN, LegalZoom & Consolidated Credit.